An important part of the market infrastructure

Ever since the first bitcoin trades, the so-called Peer to Peer (P2P) market has been important to the liquidity of bitcoin and other cryptocurrencies. The P2P market is typically coordinated on platforms where individuals post advertisements to buy and sell cryptocurrencies and then execute the trades bilaterally, sometimes with escrow services provided by the platforms.Over the years the P2P market has seen growing competition. Large centralized exchanges have emerged, and the OTC market has exploded. Lately, DeFi-exchanges, operating on platforms like Ethereum have also seen substantial growth. Nevertheless, the P2P market is still going strong, with Paxful and LocalBitcoins as the two largest players, and with a slew of smaller and often local players serving different niches.Three phases of geographic expansion

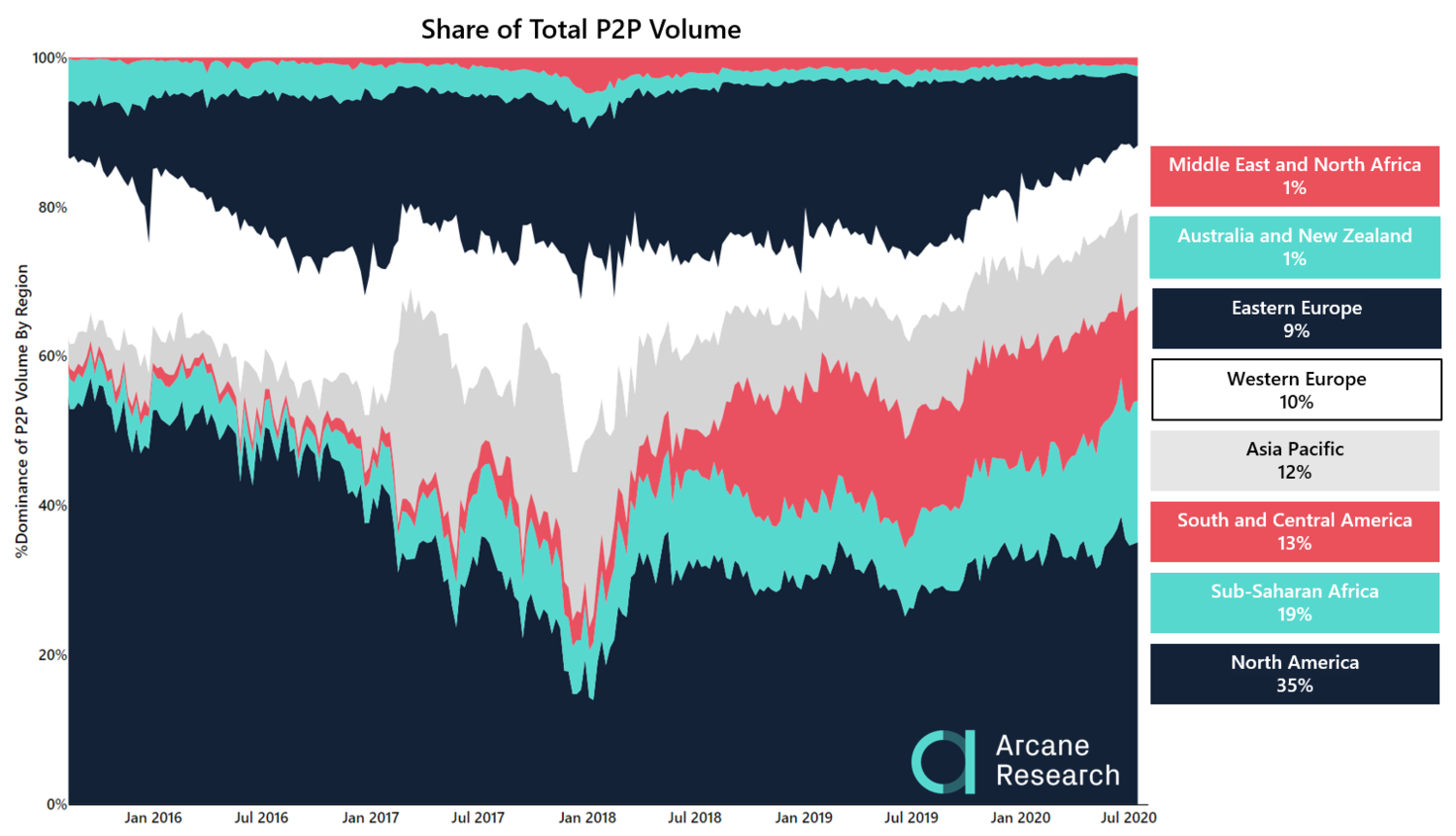

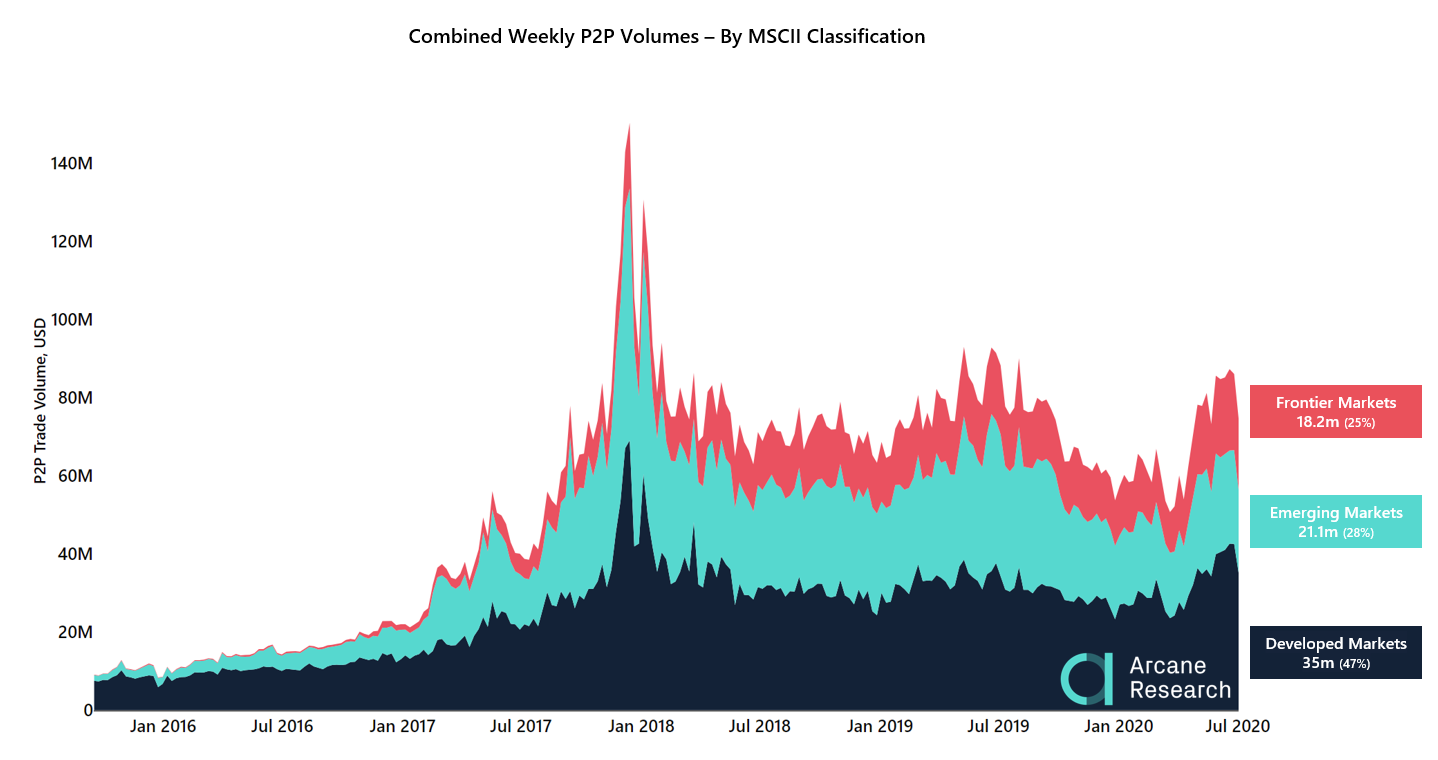

Over the years, the P2P market has seen three geographical expansion waves.- Initially it was mainly utilized in the developed economies as a way to get access to bitcoin.

- Then, during the speculative mania of 2017, relatively more participants from the emerging markets jumped onto the P2P platforms.

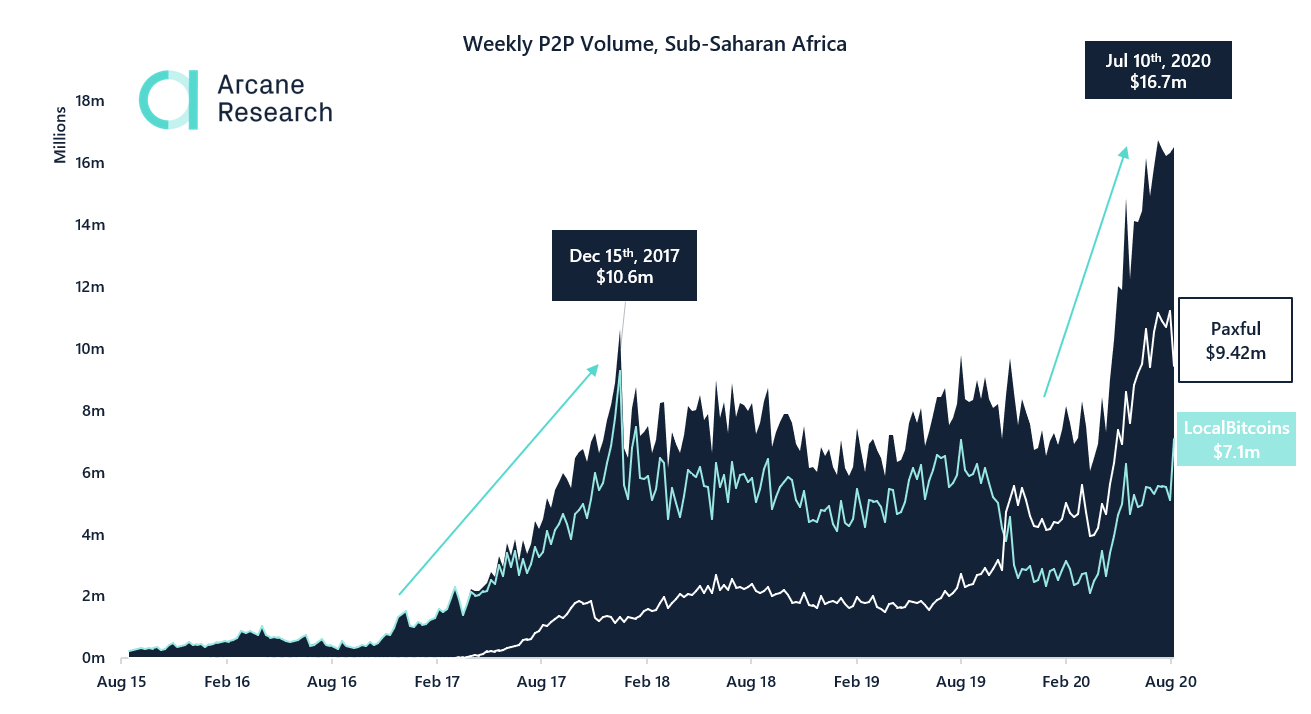

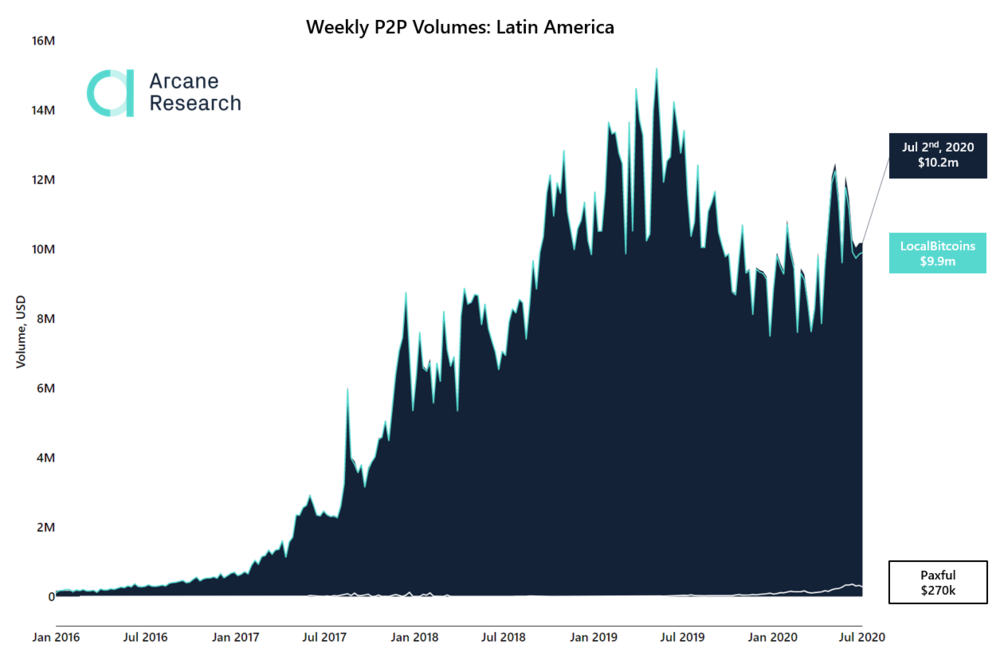

- Now, we see most of the growth in frontier markets. This can both be linked to weaker competition form centralized exchanges and to the usage of P2P platforms to conduct remittances.

A global phenomenon

The utility of bitcoin expands as new use cases are adopted. Bitcoin is a swiss army knife of use cases, enabling self-sovereignty through its decentralized design. The relatively fast transactions, without the need for a middleman, have created a borderless value transfer system, ripe and ready for increased adoption.This adoption is taking place right now, with the expansion of the P2P market into new regions, and the growth we now see in the frontier markets is evidence of the fact that bitcoin adoption is spreading and now includes all corners of the world.The analysis

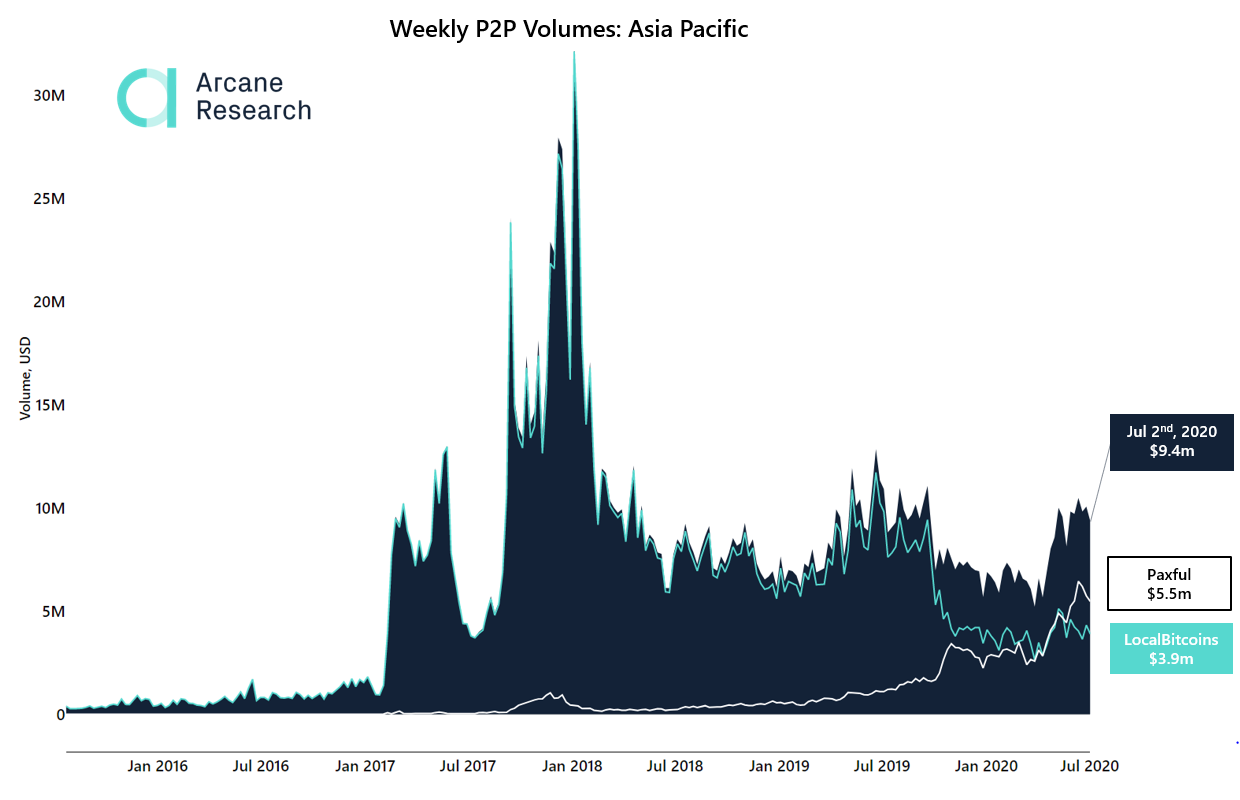

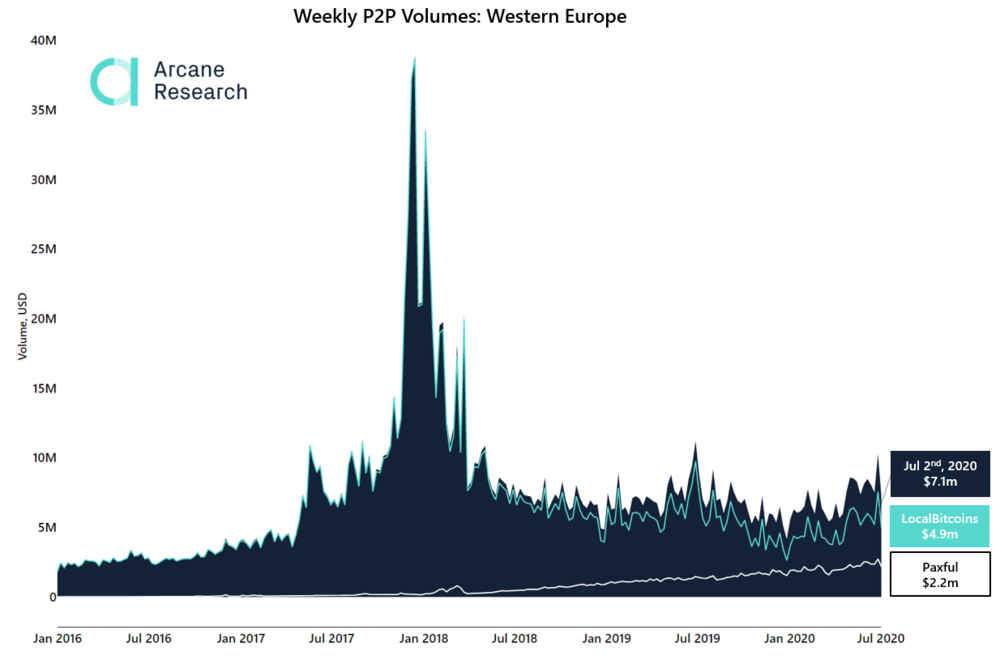

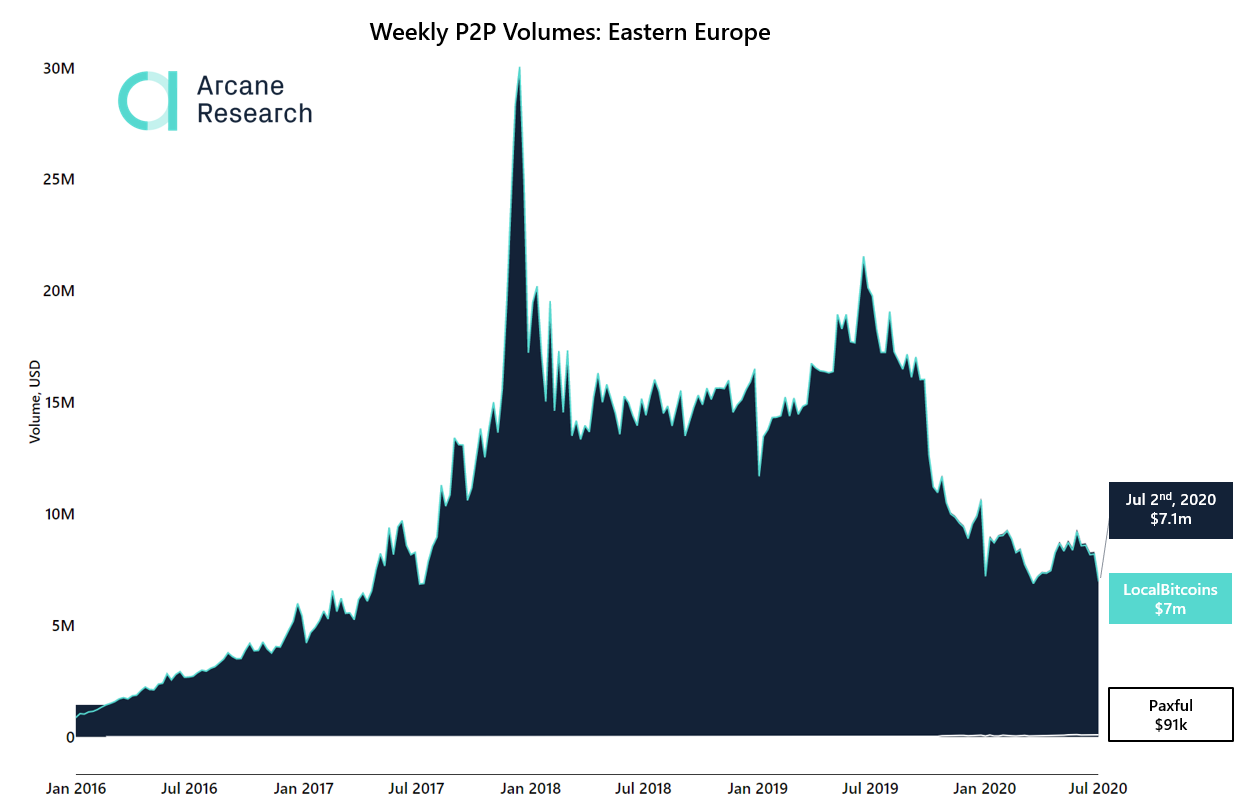

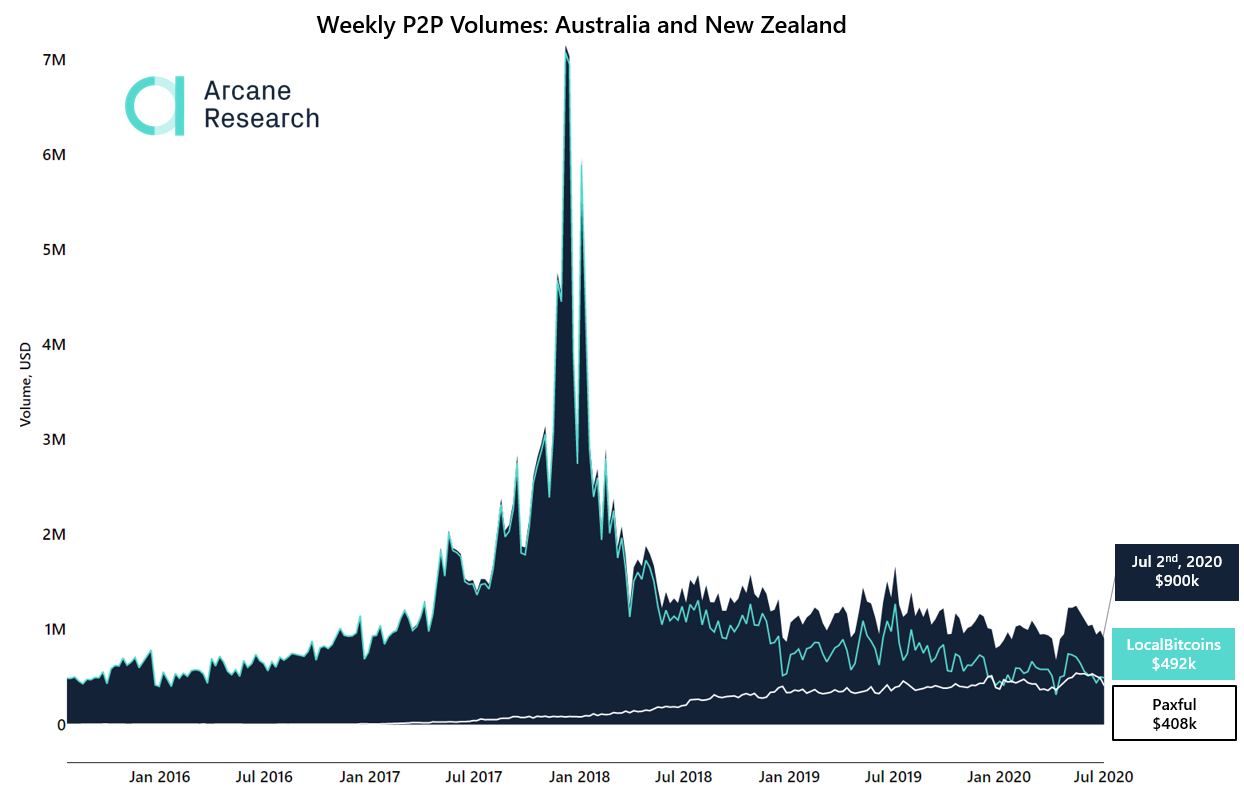

In this report we analyze the total volume on the two largest P2P platforms; Paxful and LocalBitcoins. The main reason for this has been easy access to reliable data. In our analysis, we look at the evolution over time, the geographic distribution of the activity, and the specific evolution of the two platforms. Paxful and LocalBitcoins are dominating in the market and should be a good proxy for the overall market. That said, the inclusion of only these two platforms results in an underreporting of the actual size of the market, and may lead to some biases in sum-markets, where local players may have a substantial market share.The numbers – some key takeaways

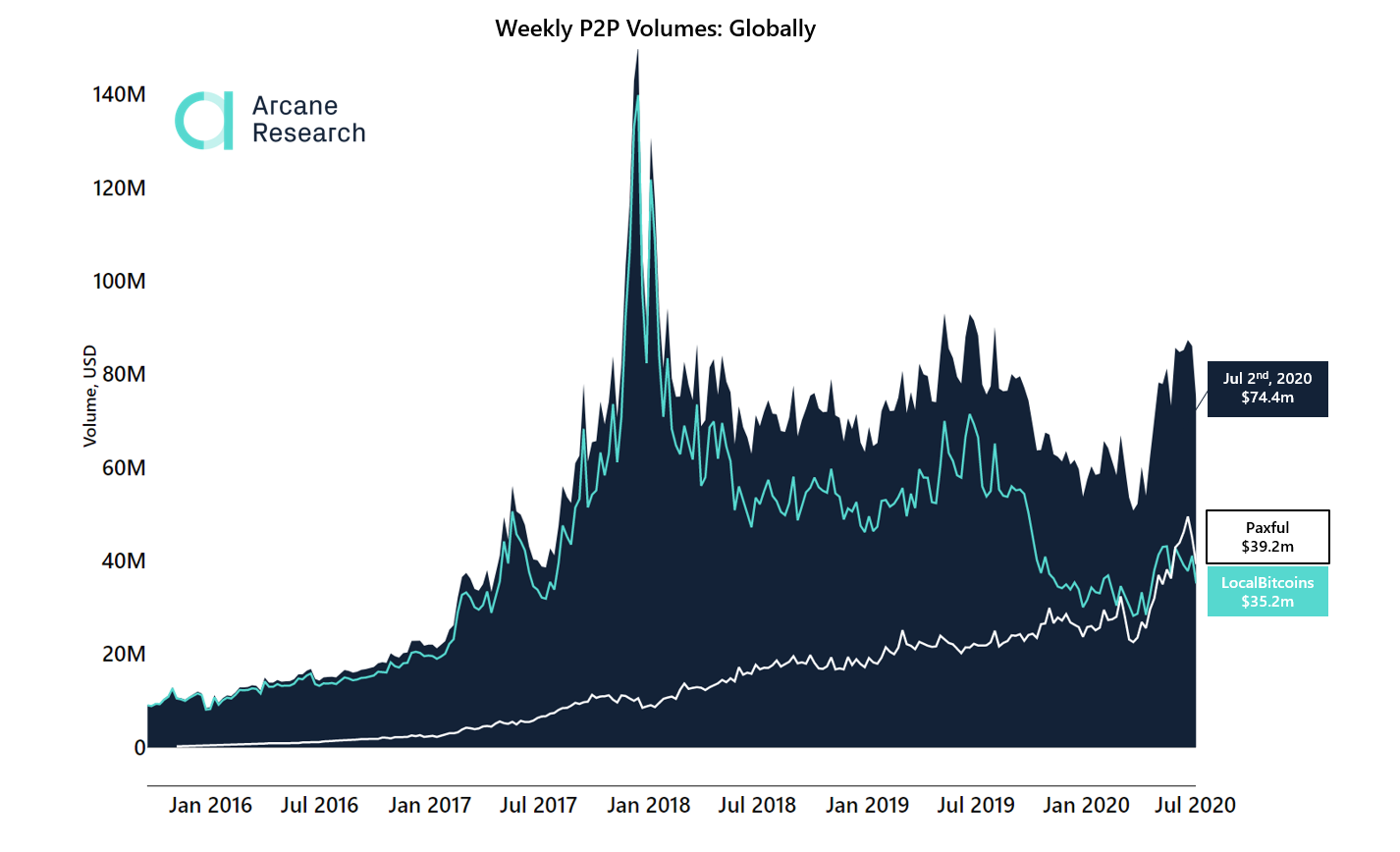

The current combined trade volume of Paxful and LocalBitcoins globally is around $75m a week. Historically the volume topped during the peak of the bitcoin bull run at more than $140m. It is important to realize that these volumes are not directly comparable to trades reported on exchanges. There is a lot of back and forth trading on exchanges, whereas all the P2P trades requires an outside settlement. The P2P volume is therefore more comparable to fiat deposit volumes.Paxful has seen stable growth the last five years, while LocalBitcoins lost significant volume during the fall of 2019 as they turned KYC compliant. Paxful thrives in the US, Sub-Saharan Africa and Asia. Paxful facilitates bitcoin purchases through various payment methods, with gift card trading accounting for 48% of the total volume as of July this year.

Preview

The numbers by region – some key takeaways

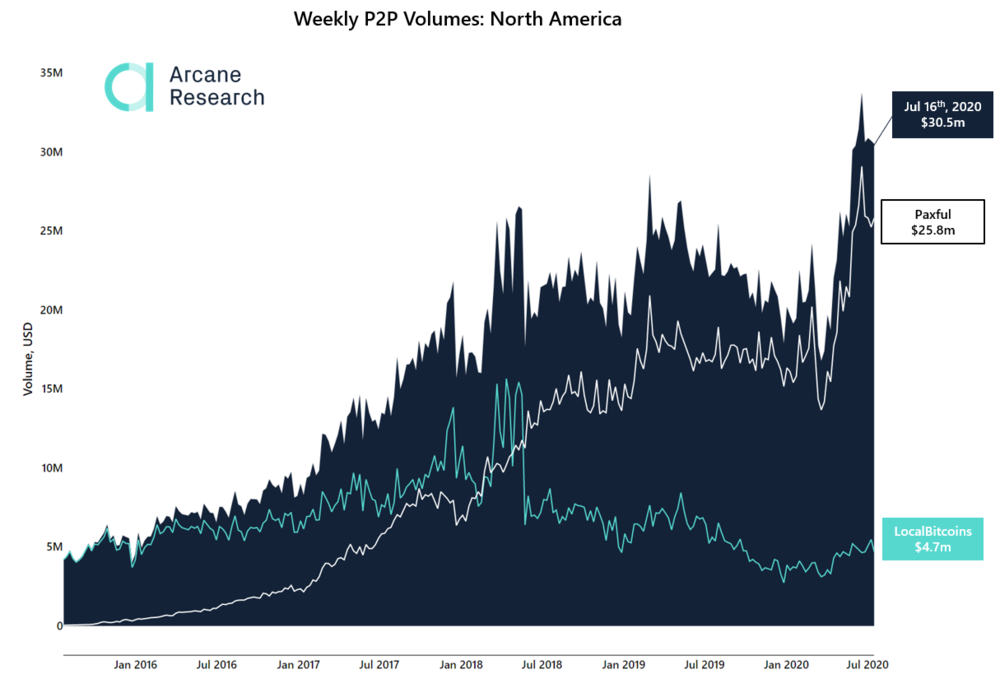

The North American P2P trading volume has seen a steady growth rate over the years, and the recent weekly volumes in North America overshoot the volumes of the bitcoin bull run of late 2017. This is only the case for two other regions, Sub-Saharan Africa and Latin America.

Preview

Preview

Preview

Preview

Preview

Preview

Preview

Teaser charts from the full report:

Preview

Preview