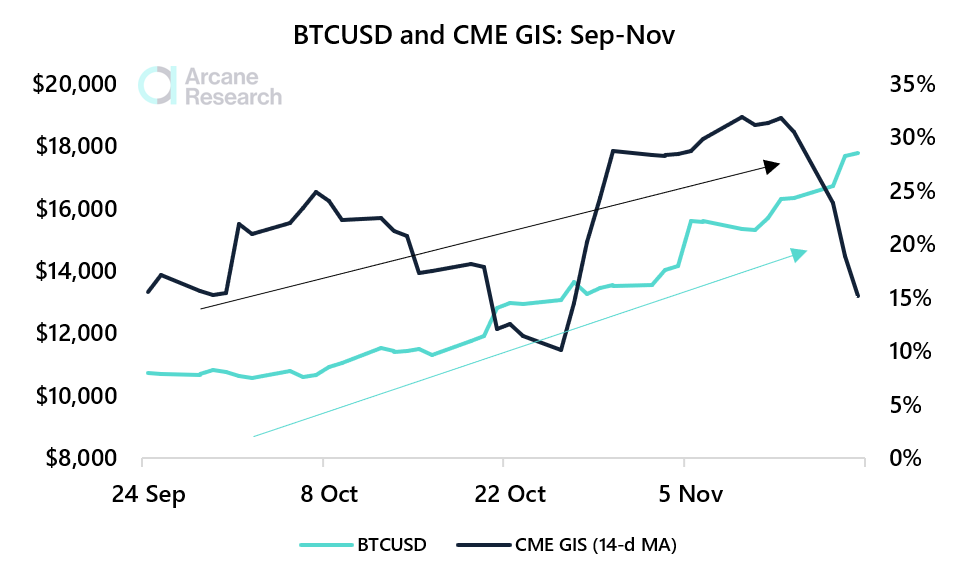

- The regulated bitcoin futures on CME has a far more pronounced price leadership role in bitcoin’s price discovery now, compared to back in 2019.

- We argue that due to the more pronounced leading role of the CME futures, the SEC should consider approving the pending bitcoin ETFs. The market has matured, and U.S. retail investors deserve a viable exchange-traded investment option for their 401Ks.

Preview

Preview

Preview

Preview

Preview

Preview

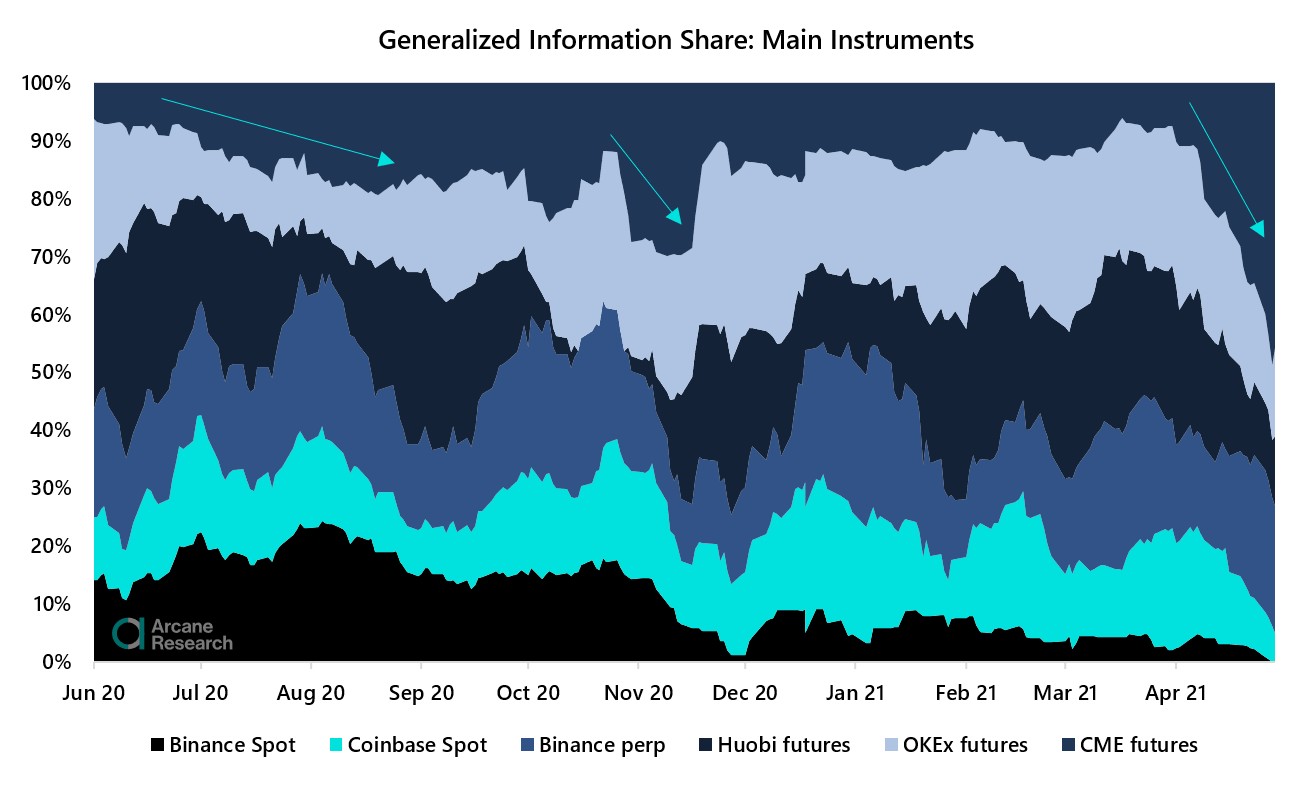

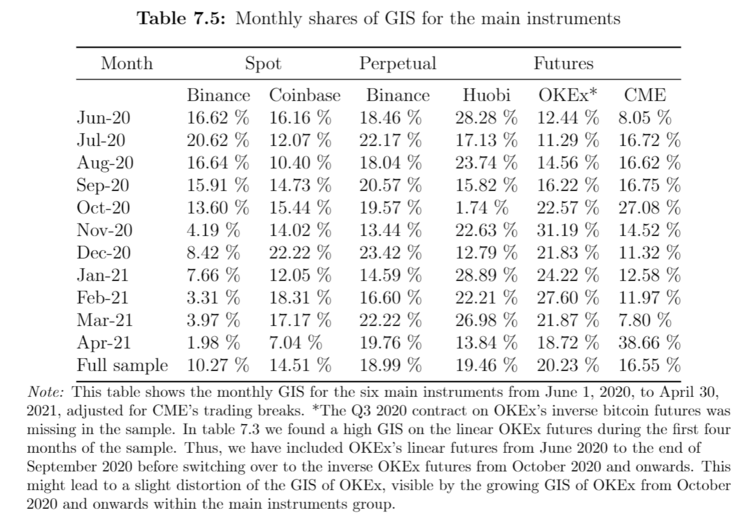

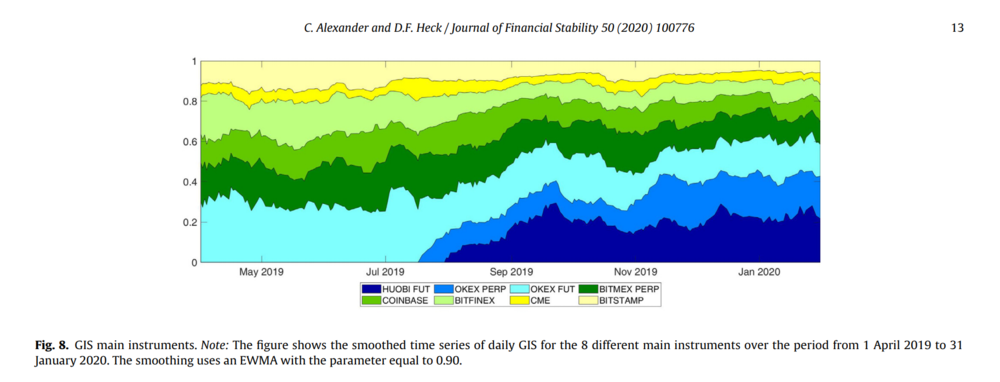

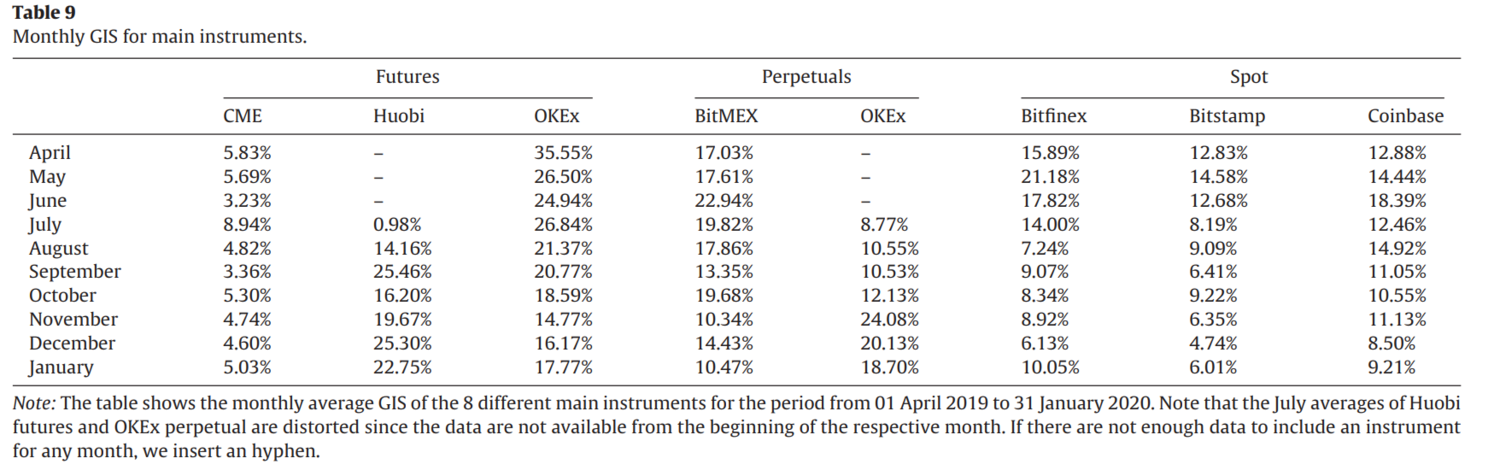

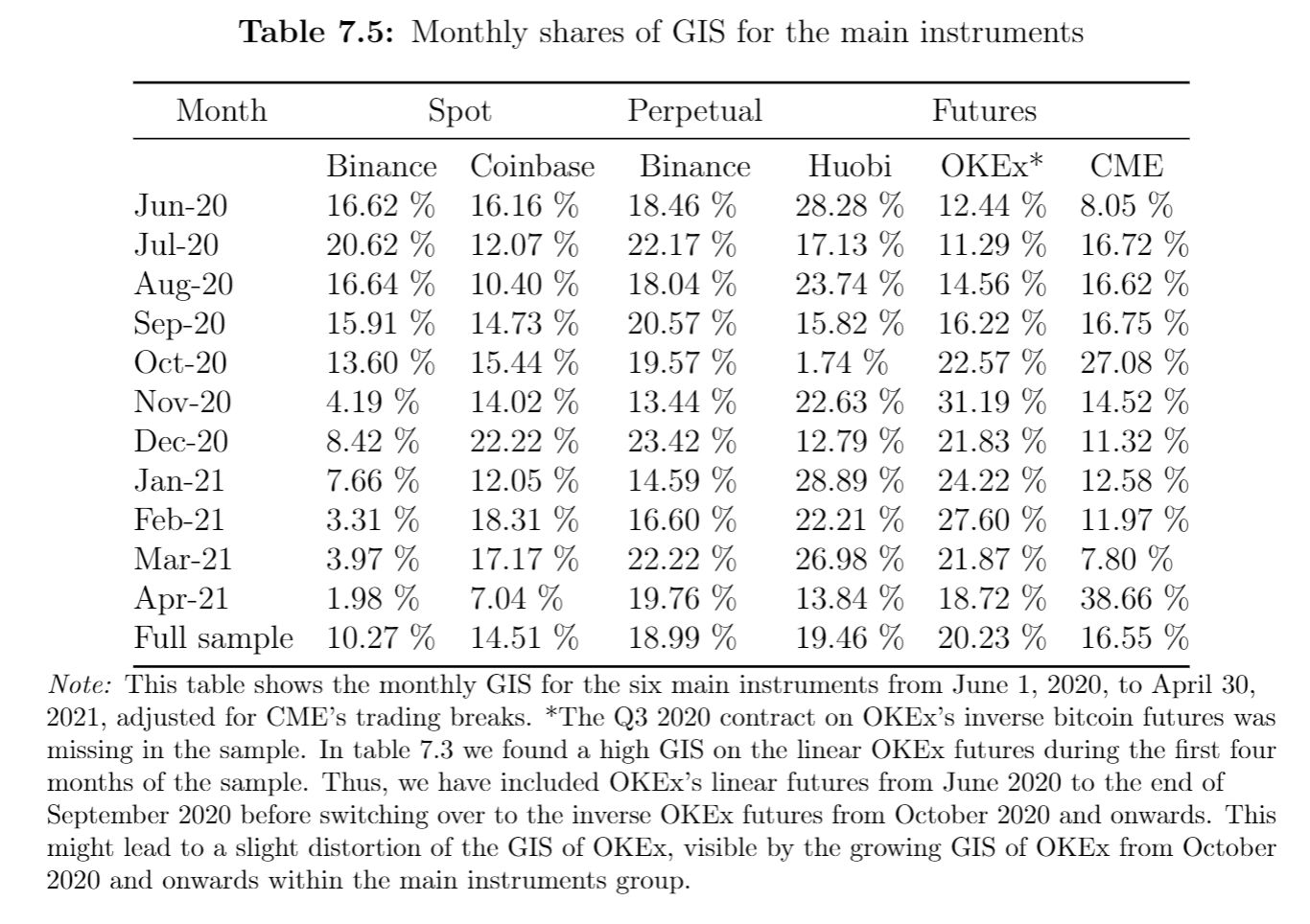

- Huobi and OKEx’s instruments seem to be the most important instruments within bitcoin’s price discovery from June 1st, 2020, to April 30th, 2021. This is similar to the findings of Carol Alexander and Daniel Heck when analyzing May 1st, 2019 to January 31st, 2020.

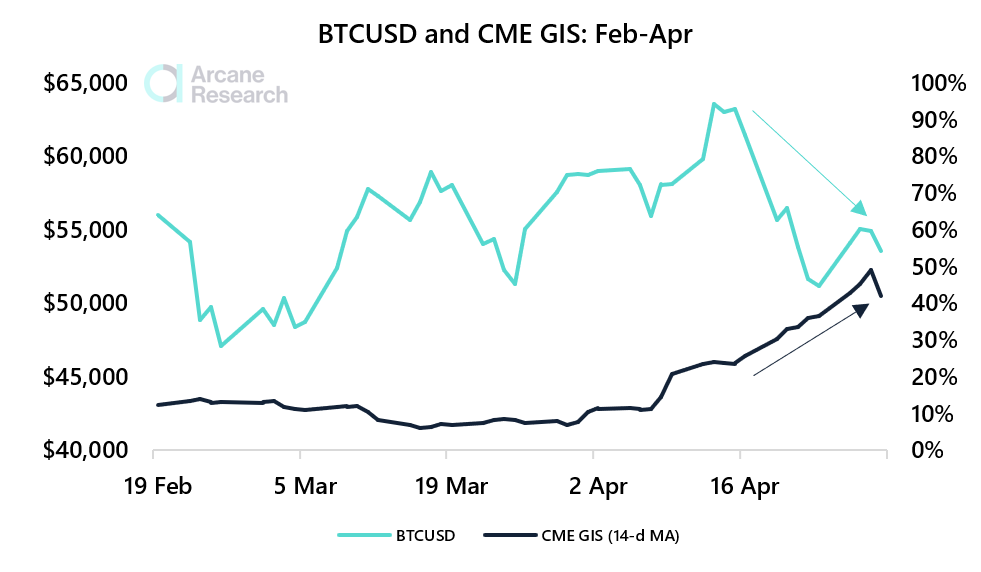

- CME and Binance bitcoin perpetuals also have a significant contribution to the price discovery in bitcoin, with CME seeing a very dominant role in April, indicating that the recent sell-off could be caused by institutional selling pressure.

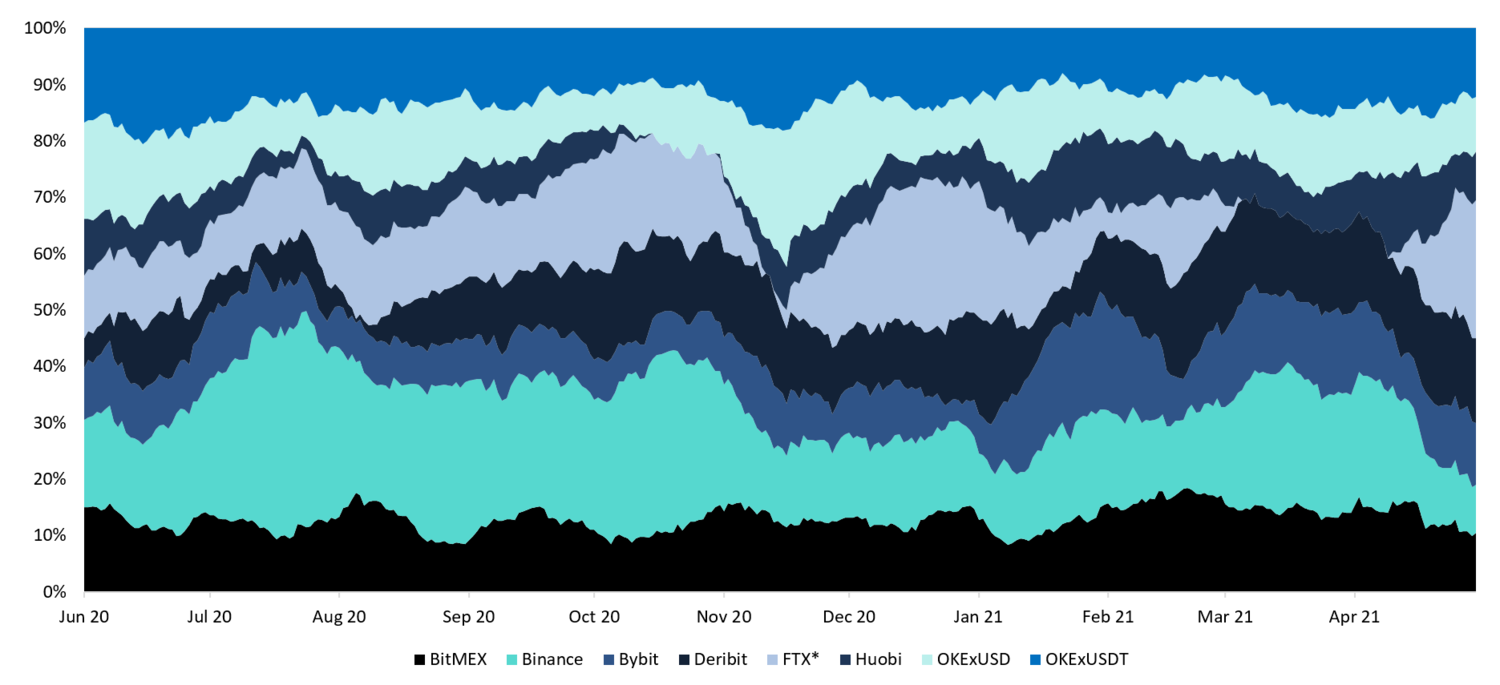

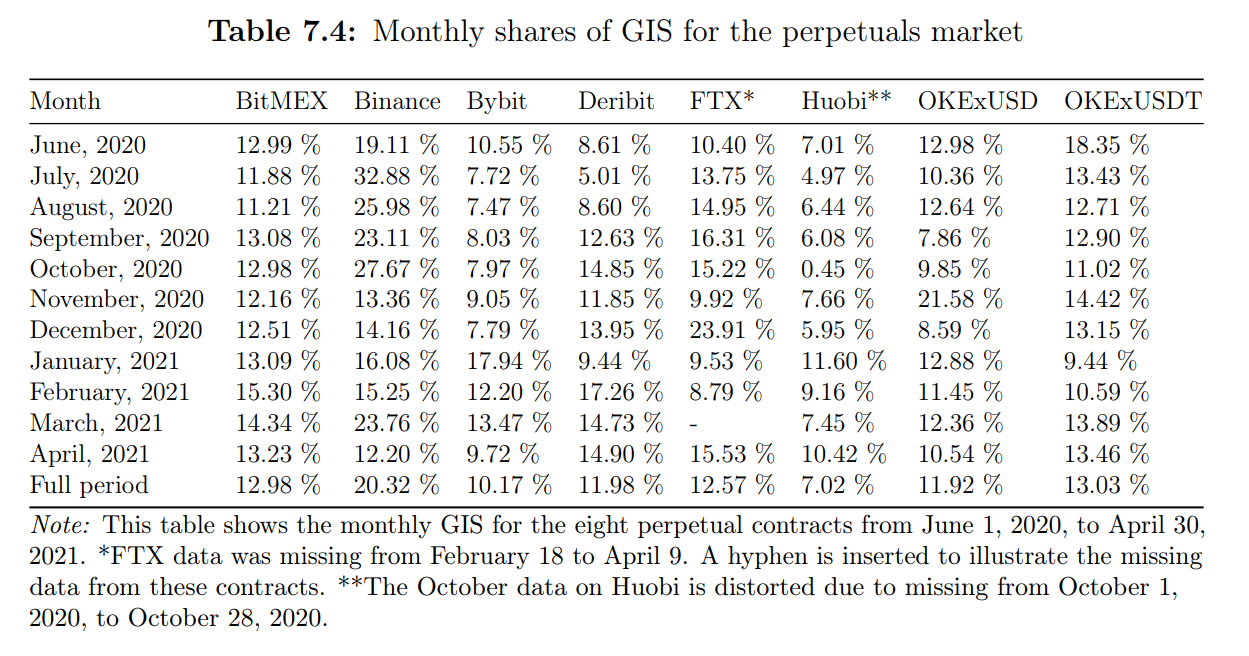

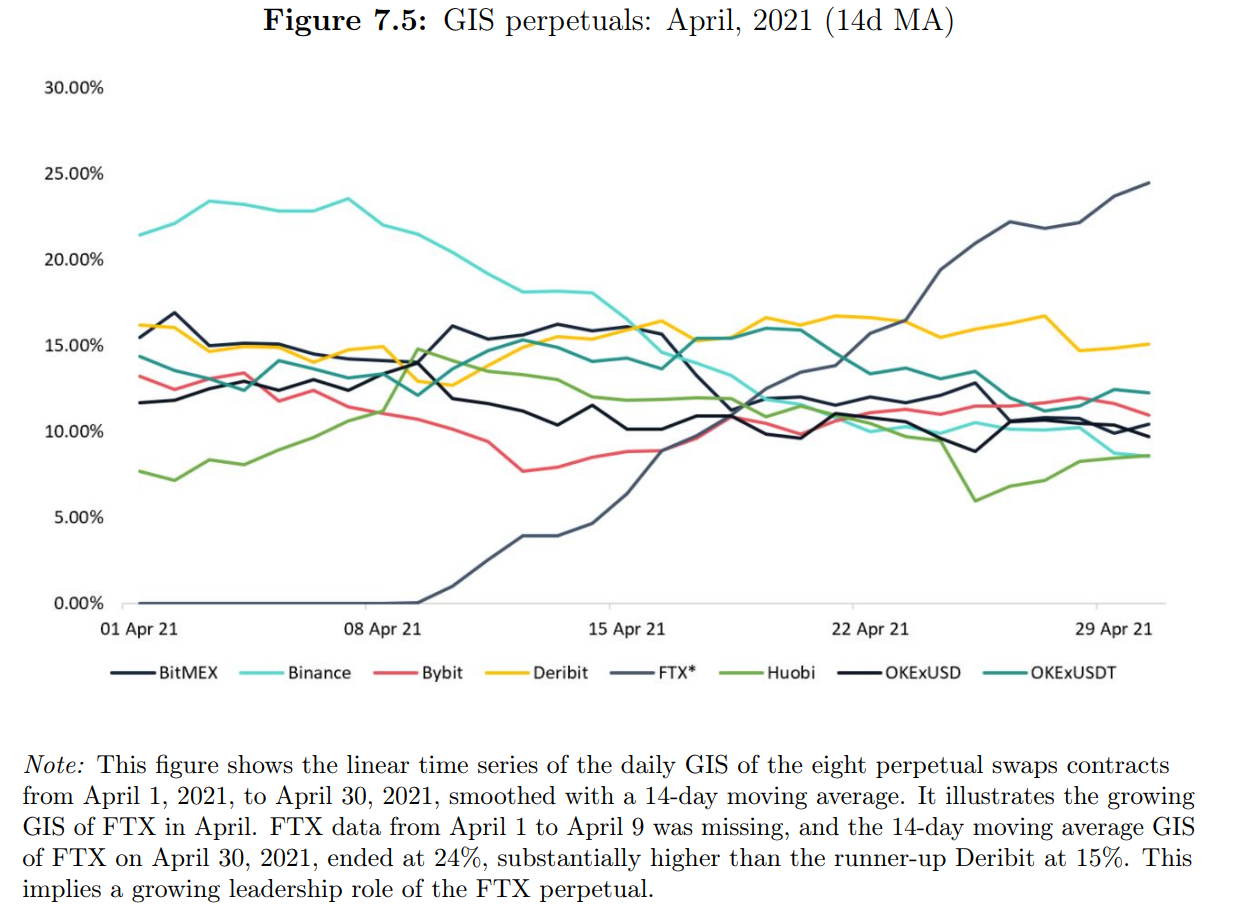

- Binance is by far the leading perpetuals instrument (within the perpetuals market), while Bybit seems highly insignificant despite its high trading volumes and open interest. FTX’s importance is growing.

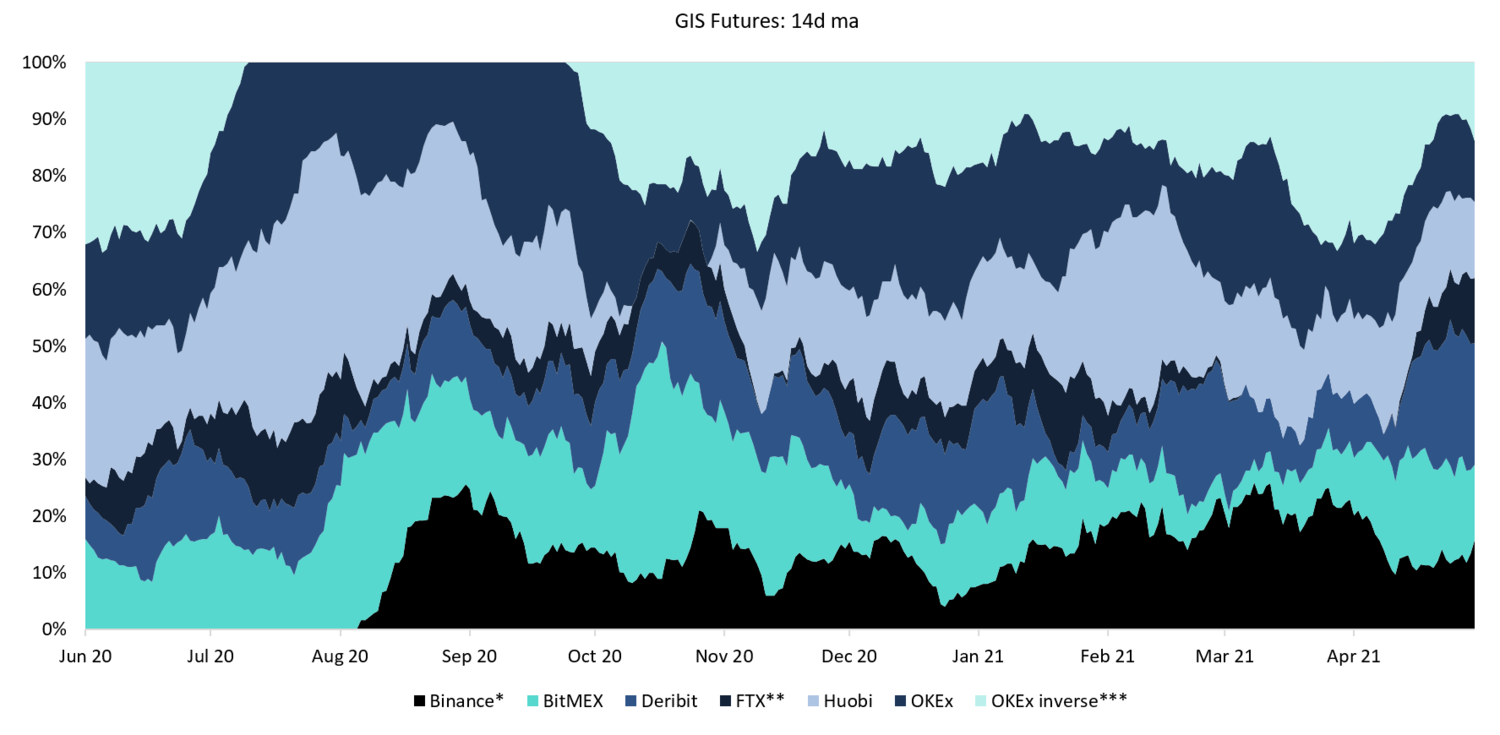

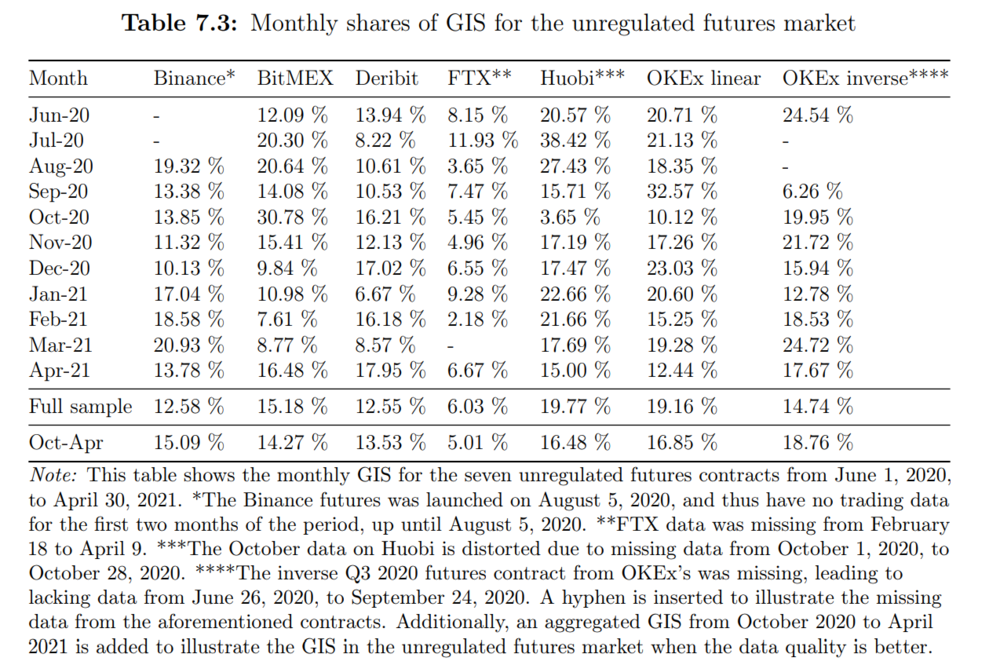

- In the unregulated futures market, OKEx and Huobi’s instruments are the most important futures instruments. Deribit has surprisingly strong information leadership given its low trading volume, possibly driven by price discovery occurring in Deribit’s options market

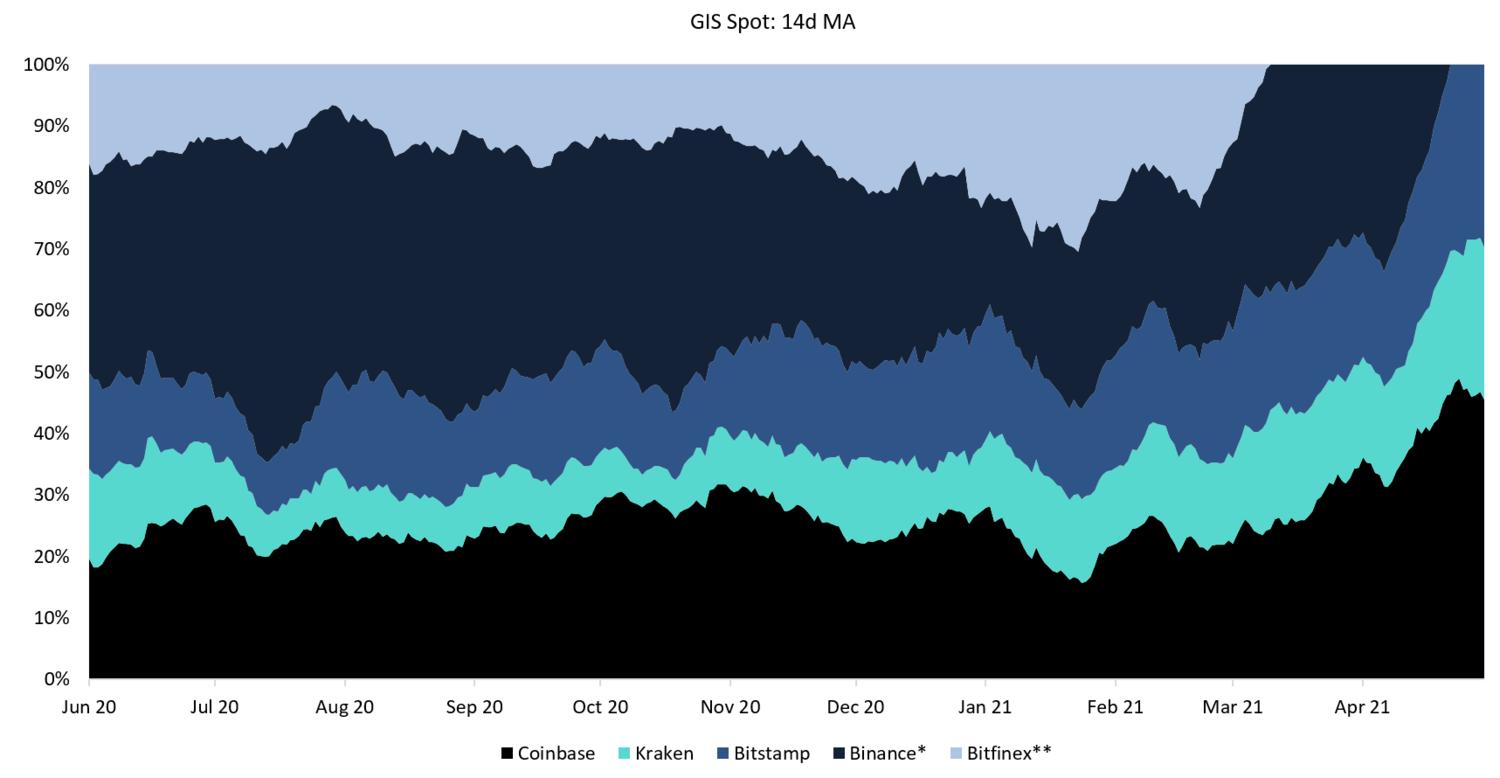

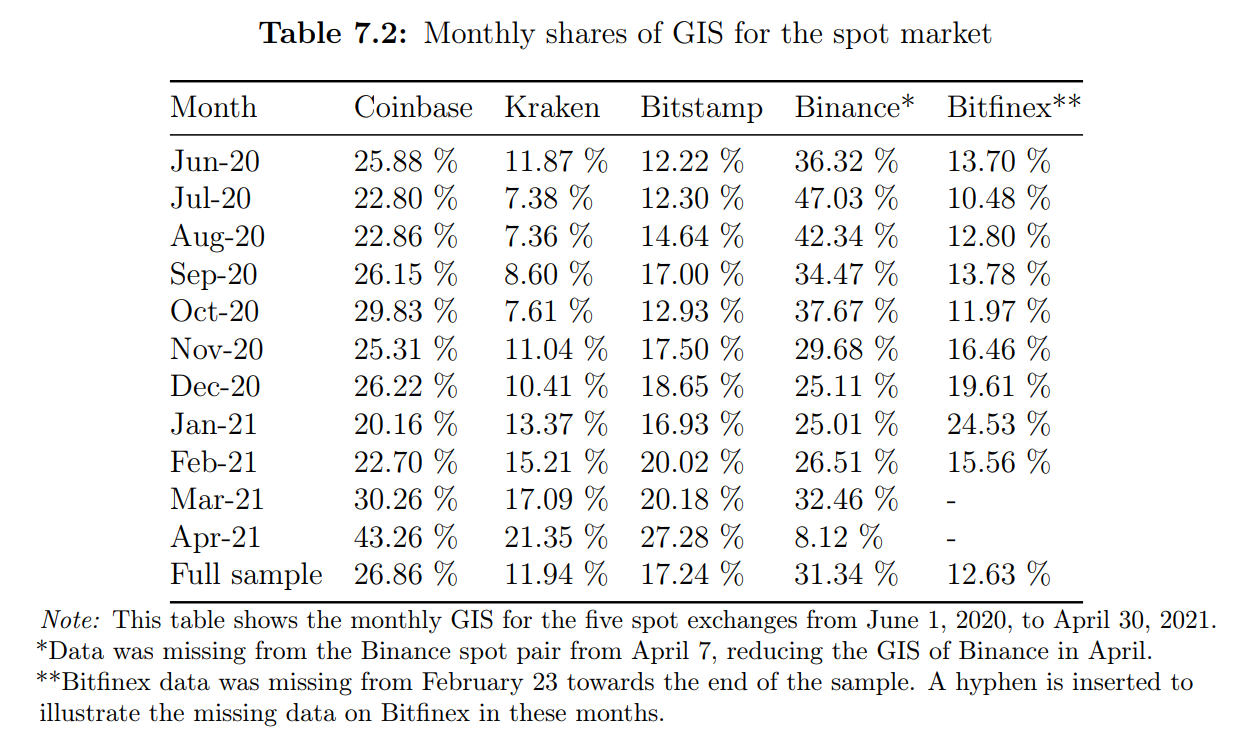

- In the spot market, Binance’s stablecoin pair dominates, and Coinbase follows. However, when analyzed together with the main instruments from each sector, Binance’s stablecoin pair is almost completely irrelevant in the last months of the sample.

Preview

Preview

Preview

Preview

Preview

Preview

Preview

Preview