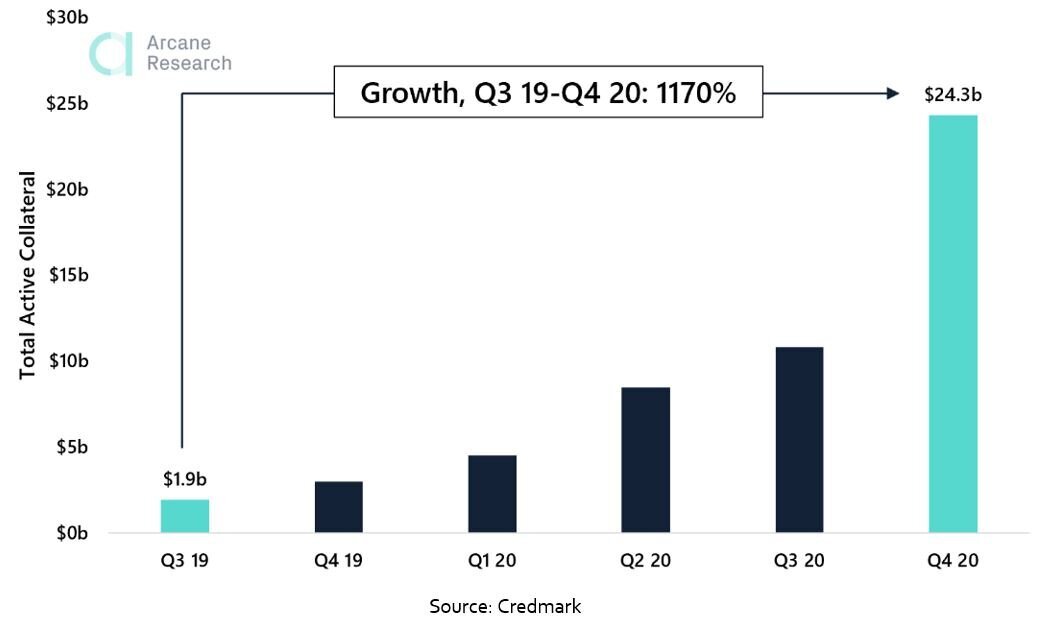

Total active collateral grew by 1170% from Q3 2019 to Q4 2020

The extensive efforts from Credmark, the market-leading crypto credit data company, show that the lending market has seen a sharp rise over the past year. From Q3 2019 to Q4 2020, the total active collateral in the lending market grew by 1170%.Total Active Collateral in the Lending Market

Preview

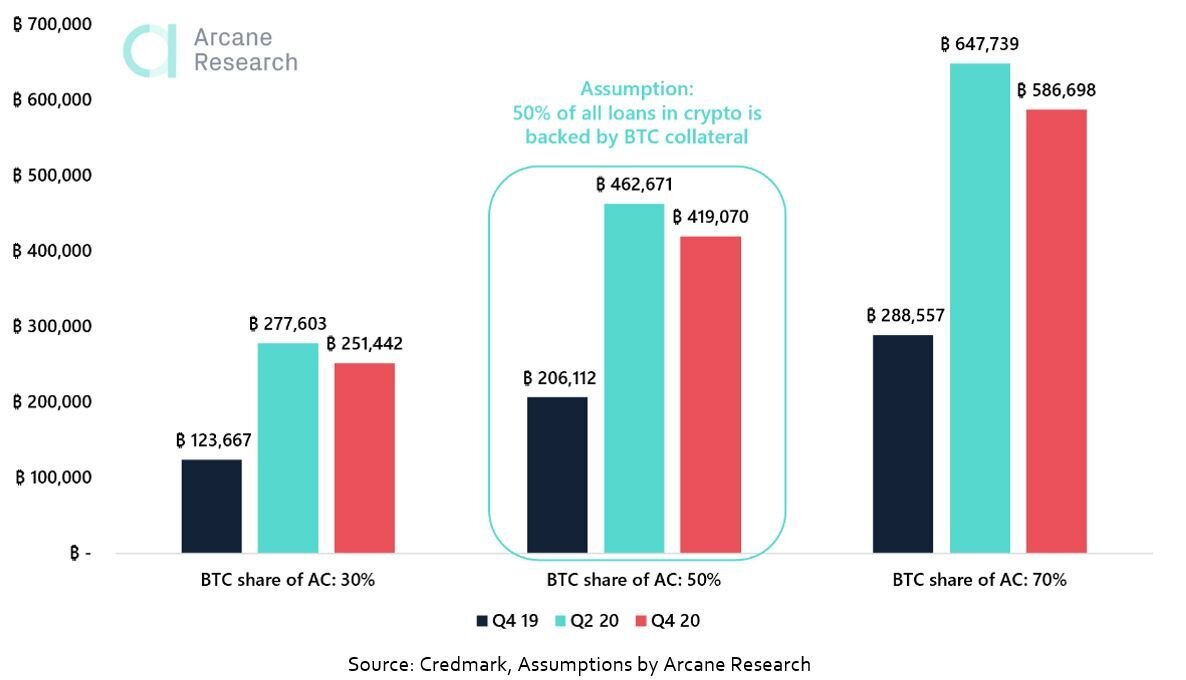

420,000 bitcoin used as collateral

The numbers from Credmark give us the approximate size of 420,000 BTC used as collateral in various loans in the lending markets, with a growth of 213,000 BTC from Q4 2019 to Q4 2020. The approximate size is based on a modest estimate of 50% of active loans being backed by bitcoin collateral. In reality, this is likely to be an underestimation, as several industry experts assume that the correct estimate is closer to 70% or 80%.Active BTC Collateral in the Lending Market (Under Various Assumptions of BTC share of collateral)

Preview

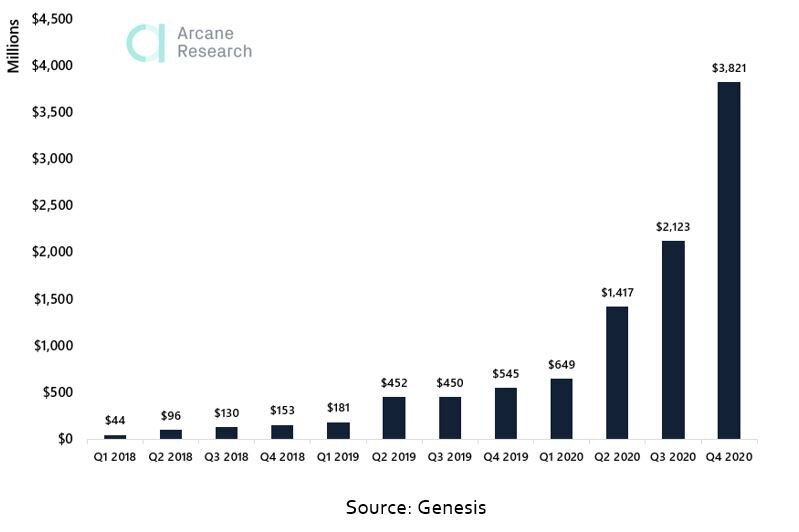

Incredible growth in 2020 for Genesis

Genesis is one of the market-leading companies in the lending market with its institutional-focused business. They have seen incredible growth over the past year, and their outstanding loans surged to $3.8 billion in the fourth quarter of 2020, a roughly 80% growth from Q3.Genesis - Active Loans Outstanding

Preview

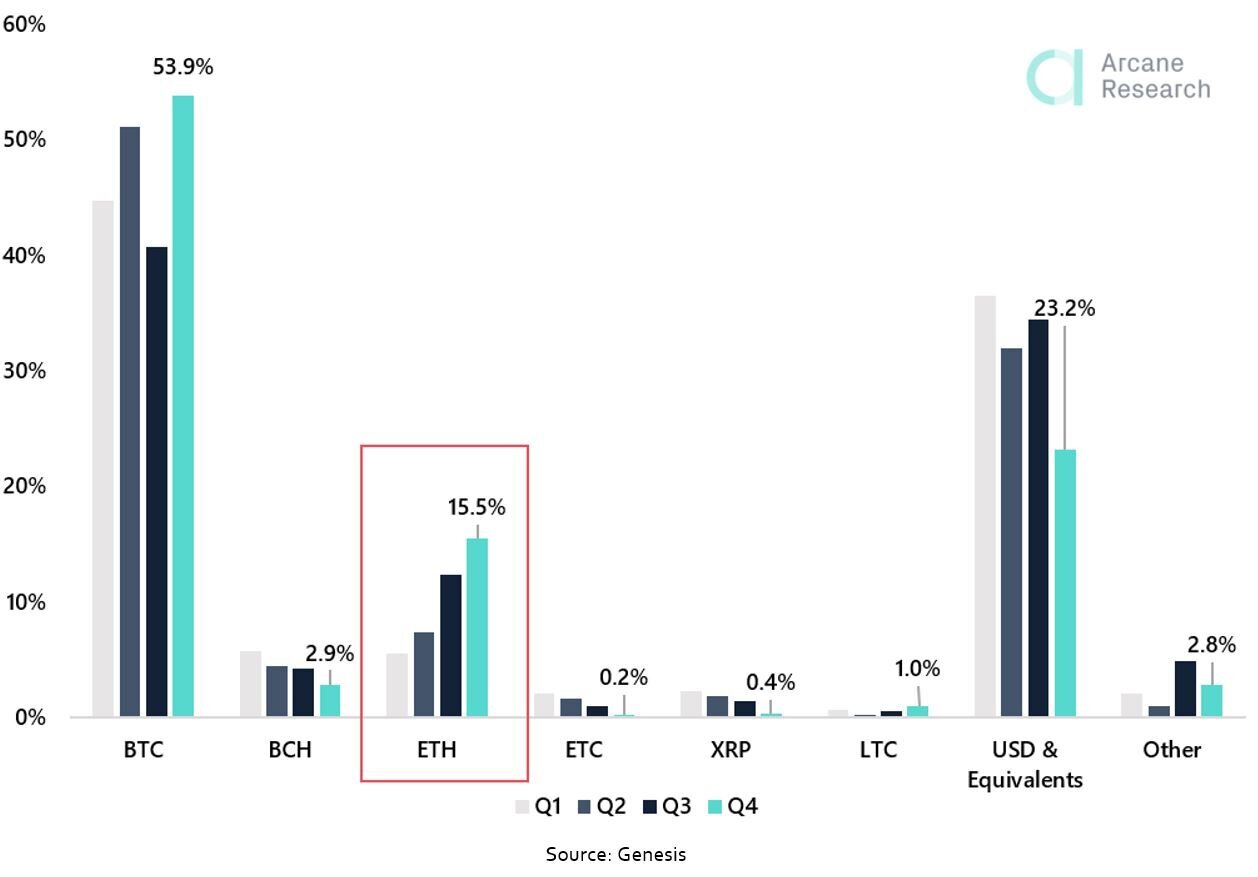

Growing demand for ETH among institutions

Although the demand for cash is clearly present, only 23.2% of Genesis' loans outstanding in the fourth quarter were USD and equivalents. The chart below shows the 2020 loan portfolio composition for Genesis.Genesis - 2020 Loan Portfolio Composition

Preview

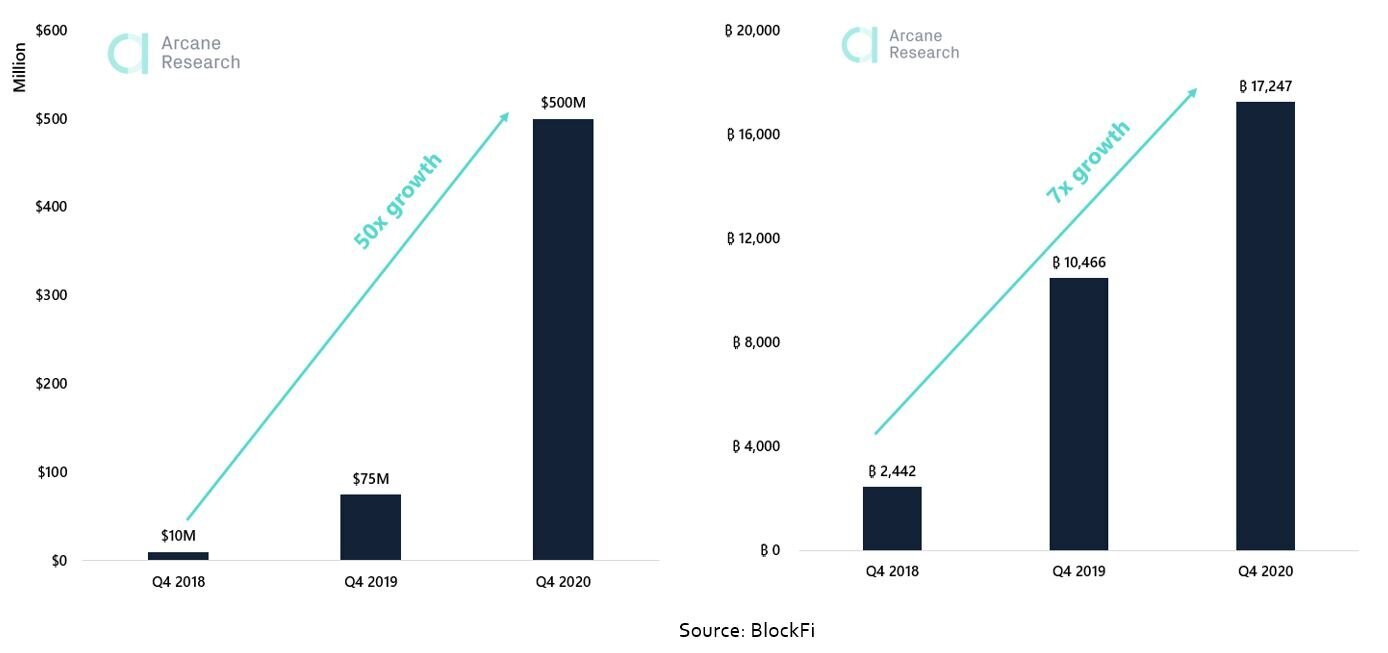

Over $4 billion in outstanding institutional loans for BlockFi

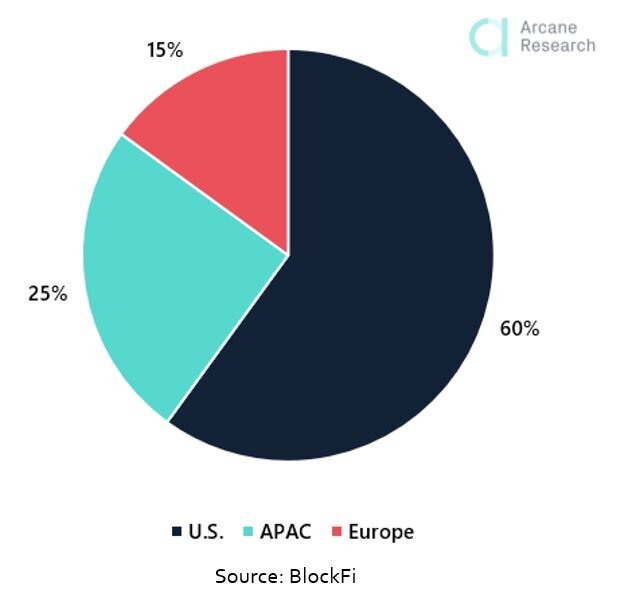

Another market-leading lending company that most readers probably are familiar with is BlockFi. The company launched in 2017 and has become one of the industry's biggest names, cleverly combining a traditional finance approach with the new possibilities of crypto finance. BlockFi's internal numbers, shared with Arcane Research, show that the company is a clear competitor to Genesis on the institutional side. In 2020, BlockFi processed $18.6 billion in loans to its institutions and private clients. The company had $4.4 billion in outstanding institutional loans by the end of 2020, and according to David Olsson, VP, Head of Institutional Distribution at BlockFi, they expect the growth to continue in 2021:“As traditional investment firms continue to adopt digital asset strategies, there is a huge vacuum in lending, which will need to be filled by efficient capital providers. We also expect further regulatory clarity globally in 2021, which will help ease any remaining institutional concerns about investing in the space.” - David Olsson, VP, Head of Institutional Distribution at BlockFiThese clients are not just based in the U.S. but spread across the world. As seen in the chart below, 60% of BlockFi’s institutional clients are based in the U.S, 25% in the Asia-Pacific and the last 15% are based in Europa.BlockFi Institutional Clients

Preview

Preview