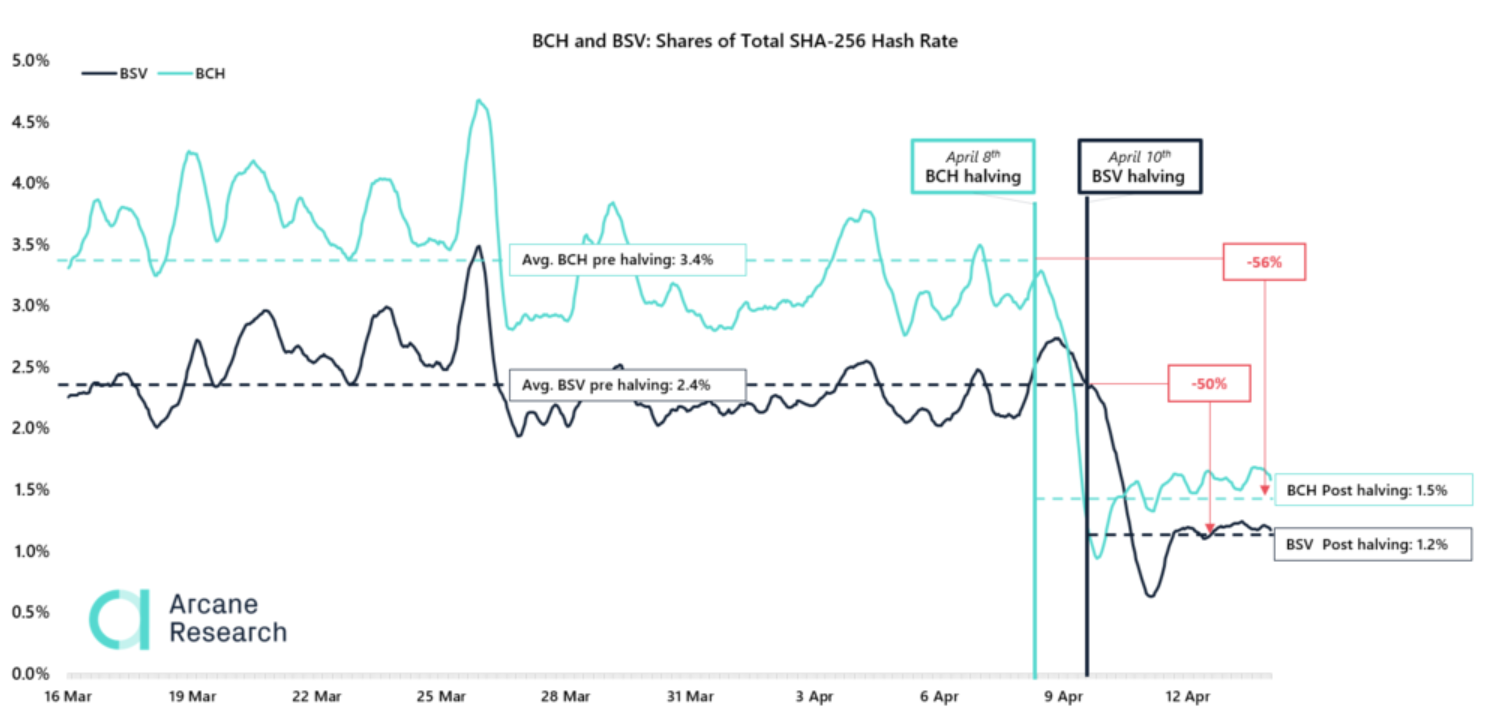

- The Bitcoin Cash share dropped from 3.4% on average to around 1.5%, a 56% reduction in hash rate.

- The Bitcoin SV share dropped form 2.39% on average to 1.19%, a 50% reduction in hash rate.

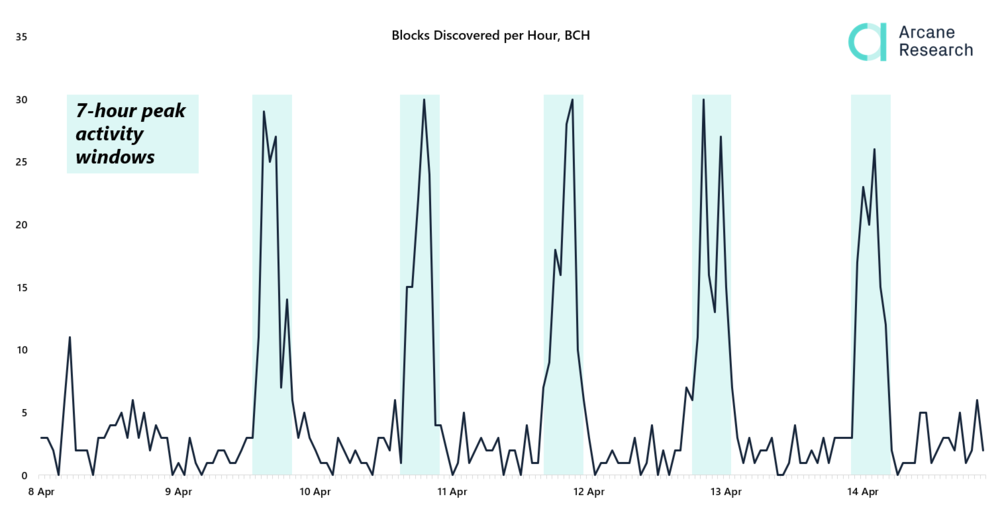

Volatile block discovery

There was an immediate impact of both the halvings in terms of block discovery by miners. In Bitcoin Cash, the blocks was on average found every 19.5 minutes the 24 hours following the halving. That is almost half the speed as the target of 10 minutes intervals.However, as Bitcoin Cash reached its 144th block past the halving, the block generation picked up speed and moved towards an average of one block every 10 minutes over a 24 hour period. This is a result of the difficulty in Bitcoin Cash being based on a block-by-block readjustment based on a moving average of the hash rate commited over the last 144 blocks. Still, the amount of blocks generated per hour in Bitcoin Cash has been far more volatile than prior to the halving.

Preview

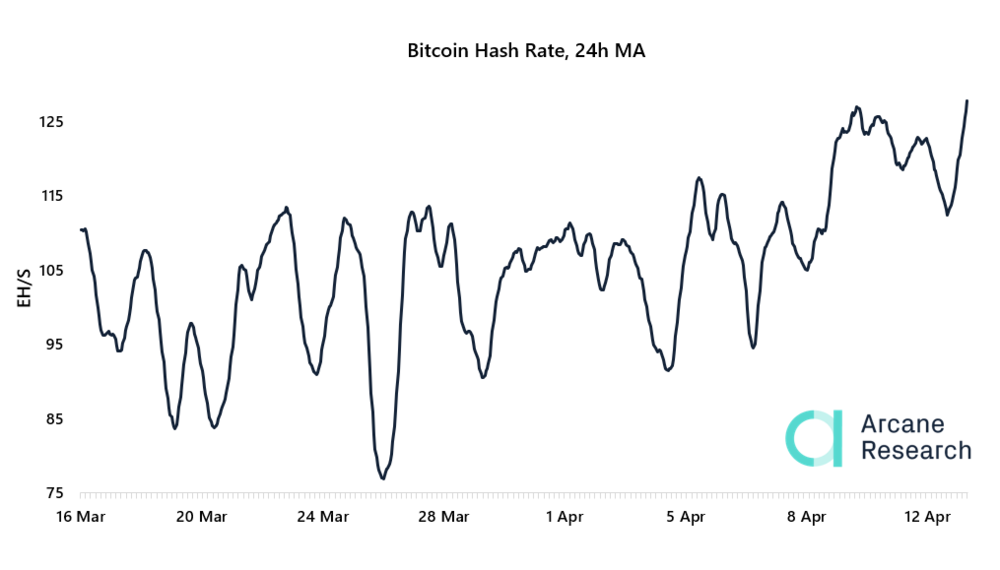

Bitcoin mining is approaching a new all time high

Amidst the rapid reduction in hash rate of the bitcoin forks, bitcoin itself has seen an increase in hash rate. This rise is to some extent explained by miners of BCH and BSV moving over to mining bitcoin, as it became relatively more profitable. Still, that would only account for an increase of around 3 exa hashes per second. The bitcoin hash rate, however, has grown with around 15 exa hashes since the halvings. This suggest that miner migration is only a part of the explanation behind the recent growth of bitcoin mining.

Preview