What is a bitcoin ETF

An exchange-traded fund (ETF) is an investment vehicle tracking an index or asset, which can be purchased on a stock exchange. ETFs currently exist in abundance for other equities and commodities, both with and without leverage. Yet, bitcoin-based ETFs have still yet to be accepted by the SEC. Already in 2013, the Winklevii’s attempted to launch an ETF, but it was rejected by the SEC. Since many have tried, and none have succeeded. The SEC has previously argued that the risk of market manipulation within the bitcoin markets is high due to the high concentration of the trading activity in bitcoin occurring on unregulated markets. However, in recent years, the market structure has, by all accounts, adjusted. Now, the institutional footprint in the bitcoin trading ecosystem is massive. Further, as we presented in June, the role of CME’s BTC futures in bitcoin’s price discovery has become very substantial. This could speak in favor of an ETF approval in Q4 or Q1, 2022, but the consensus seems relatively unclear on this matter at the moment.In general, the U.S. bitcoin ETF application landscape currently consists of two different structures:

- “Physically” backed Bitcoin ETFs with direct bitcoin exposure (hereby called spot-based), seeking to mimic the BTC price, with an active redemption program allowing market makers to create and redeem shares at will. This dynamic should lead the ETF share price to reflect the value of the assets under management by the fund, being a more efficient alternative than close-ended funds such as the Grayscale Bitcoin Trust, seeing fluctuating premiums and discounts to its NAV. The fund maintains the custody of the funds, which is convenient for investors seeking pure exposure without going through the hassle of maintaining custody on their own.

- Futures-based ETFs. These are bitcoin ETFs based on other available bitcoin investment vehicles, namely the CME BTC futures. A majority of the filings within this category also seek to invest in ETFs with direct bitcoin exposure based in Canada or close-ended funds such as Grayscale. These ETFs will not hold direct BTC exposure, have to roll over futures, and/or invest in other funds with direct exposure.

Why should you care about these ETFs?

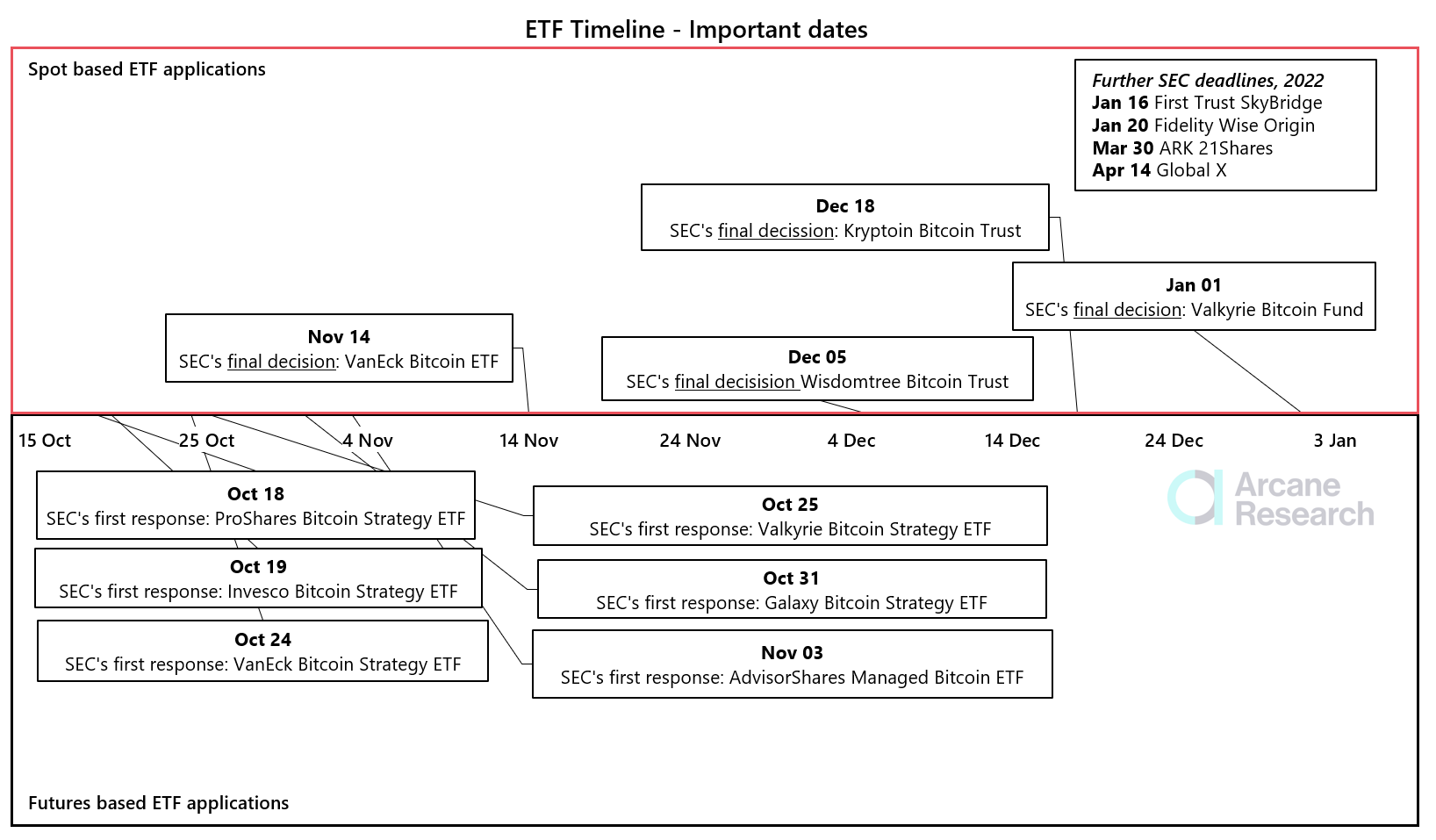

So, now you know what an ETF is, and what kinds of bitcoin ETF filings we’re dealing with at the moment. Let me briefly inform you on why you should care about these ETFs. Firstly, for the American retail saver, these ETFs may be traded through the tax-deferred or tax-exempt 401(k) plans. This allows U.S. retail savers to invest their pension savings into investments with direct bitcoin exposure. These investors currently have the opportunity to invest in other kinds of funds with bitcoin exposure through their 401(k)s, but these funds have some undesirable drawdowns. This is best exemplified with the Grayscale Bitcoin Trust (GBTC). GBTC has an unfortunate structure without an active redemption program and lock-up periods. This leads to huge divergences between the share price of the fund and the net asset value of the fund. As of writing, BTC has seen a YTD return of 48%, whereas GBTC has seen a YTD return of -8%. My position on the ETF matter is that further rejections carry more harm than good. U.S. retail investors deserve a well-structured bitcoin ETF, and their interests should be considered by the SEC. Secondly, ETFs could be very bullish for bitcoin. They will allow more institutional investors to invest in bitcoin through an easily accessible investment vehicle, following the regulated standards that they are used to. Initially, these funds could attract a lot of capital, leading to an increased buying pressure, absorbing some of the bitcoin supply. Market participants could try to front-run this, leading to volatility going into the ETF verdict dates, but now I am getting ahead of myself. I’ll add my two cents on the possible price impact of these ETFs later in this post.Alternatives today

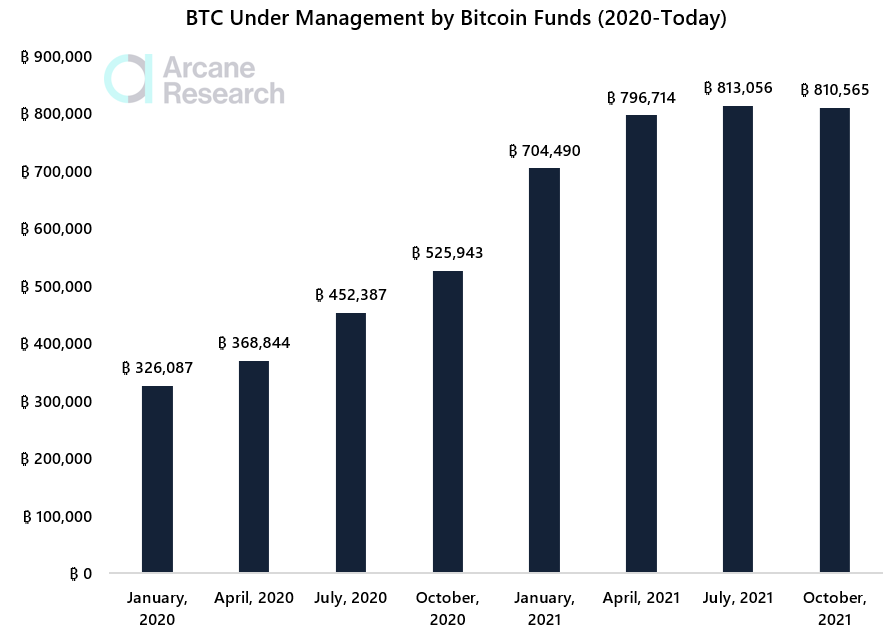

There are several alternative bitcoin funds in existence today. Close-ended funds such as Grayscale, Osprey, and 3iQ (QBTC) are one of them. Other exchange-traded products, such as exchange-traded notes, are also available, mostly in Europe. Some of these ETNs are based on unsecured debt notes, while others share the same characteristics as the American ETFs and are physically backed, such as CoinShares Physical Bitcoin ETN. According to European regulation, ETFs have to be diversified and cannot be solemnly based on one underlying asset. In addition to the aforementioned funds, we’ve already seen some jurisdictions approving ETFs, with both Canada and Brazil having active bitcoin ETFs today. In sum, the bitcoin funds today hold approximately 800,000 BTC, equalling 4.2% of the circulating BTC supply, with Grayscale alone holding 650,000 BTC.

Preview

ETF filing overview

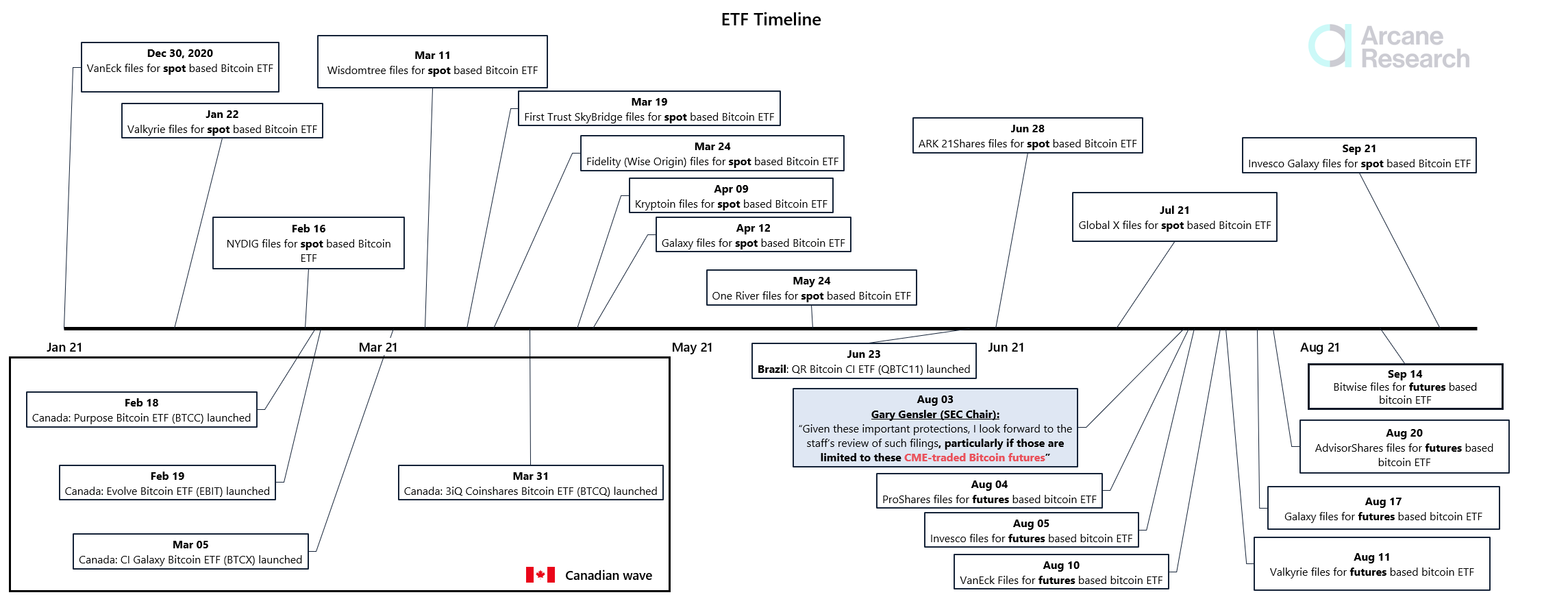

Here we provide a detailed overview of the current ETF application landscape. Throughout the spring, all ETF filings were spot-based (“physical bitcoin”). During this period, both Canada and Brazil approved BTC ETFs, while the U.S. picture remained unclear with several postponements of the final call.Currently, there are 12 pending spot-based ETF applications and 7 futures-based ETF applications. All the futures-based applications came en-masse following Gary Gensler's August 3rd comments (later reiterated on Sept 30th).“Given these important protections, I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded Bitcoin futures” - Gary Gensler

Preview

Preview