Flexibility: A crucial but often overlooked factor in electricity systems

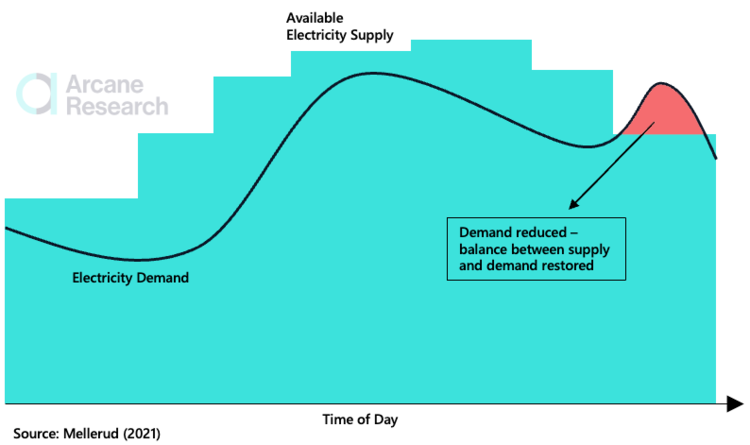

In electricity systems, supply and demand must be balanced in real-time since electricity cannot easily be stored. The electricity supply going into the system must equal the demand at all times. If the supply gets higher than the demand, transmission lines or other equipment can get fried. On the other hand, customers will be out of electricity if the supply gets lower than the demand.Balancing the system is very complicated since supply and demand vary over time and can never be known 100% beforehand. Power companies have become adept at estimating future demand, but as with all modelling, it involves errors. The margin of error is more significant the further into the future the estimation is. On the supply side, power generators or other equipment can go down, or in the case of wind and solar - the wind can suddenly stop blowing, or the sun can suddenly stop shining. The flexibility in the system balances supply and demand in case of either supply shocks or failures in demand estimation. Both resources on the supply side and the demand side can provide flexibility. Historically, the supply side alone has provided the needed flexibility by adjusting power plant output to match the real-time demand. Natural gas power plants are especially suited as peaker plants - holding back supply until demand increases and firing on all cylinders to meet the rising demand. A traditional electricity system often consisted of colossal coal power plants that met the baseload - the minimum level of demand typically seen over 24 hours, and natural gas-powered peaker-plants adjusting the supply to match the demand at any given time.Why do we need demand response?

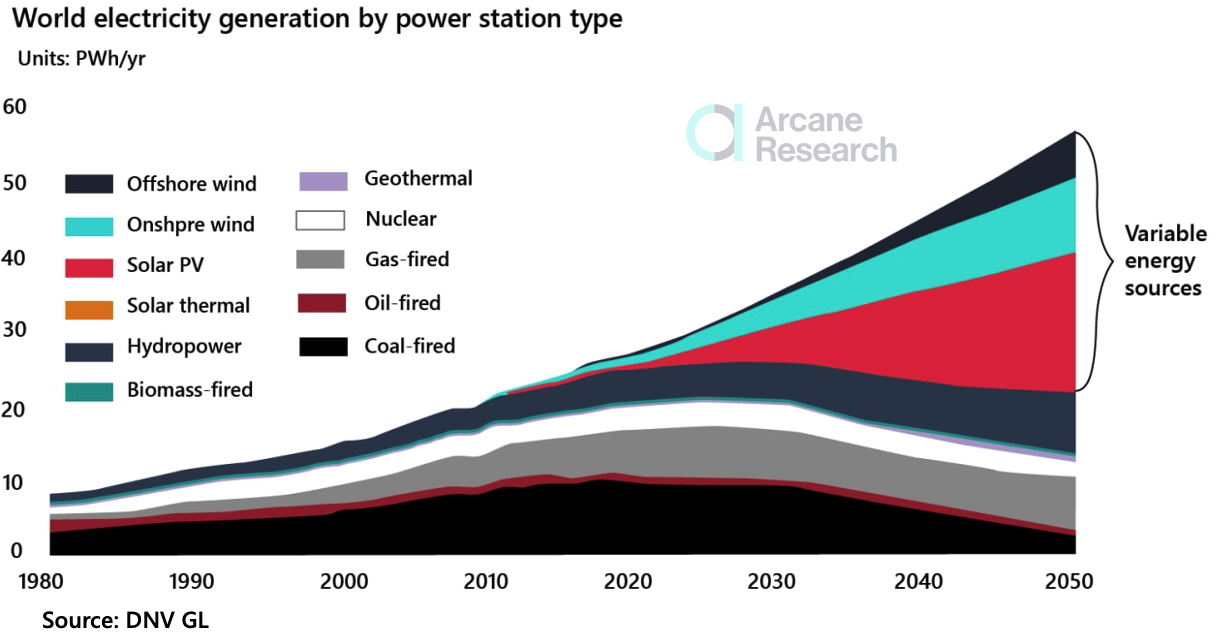

In recent years, a new flexibility challenge has arisen that can potentially create grave dangers for the security of the electricity supply if left unmitigated. We are in the middle of an energy transition where we replace fossil fuels with renewable energy, fueled by massive growth in wind and solar. These are so-called variable renewable energy sources, which means that they only produce electricity when the weather conditions allow for it. Unfortunately, the weather does not consider the demand for electricity before deciding to turn up as sun or wind. In addition, even the best weather forecasting models are prone to occasional errors. Since they are uncontrollable resources, wind and solar can't provide flexibility. Because of these characteristics of variable renewable energy sources, a growth in their share in the electricity mix reduces the supply side's predictability and flexibility, pushing flexibility responsibilities over on the demand side. To illustrate how seriously the energy transition will reduce the supply side's flexibility, here are some numbers: Fernández & Taibi (2019) estimate that to meet the goals of the Paris Agreement, the share of renewable energy in global electricity generation must increase from 25% in 2019 to 86% in 2050. They also predict that from this 86%, about 70% will come from variable sources (wind and solar), which means that variable sources in 2050 will account for around 60% of global electricity generation, against 10% in 2020 (Ember, 2020).

Preview

What is demand response?

Preview

What characterizes processes that are suitable as demand response?

Although it can be lucrative to participate in demand response programs, not all electricity consumers can deliver these services. Certain power consumption characteristics enable a process to be used for demand response. These are the demand response flexibility factors (Mellerud, 2021):- High energy intensity: The task of demand response is for a consumer to reduce its electricity consumption in certain situations so that other, less flexible consumers can instead enjoy the released electricity. For the discharged electricity to make a difference for the grid, the released electricity must be of a meaningful amount. EnelX (2020) states that a process should at least be able to reduce 100 kilowatts of electricity to be a good candidate for demand response.

- Low reaction time: A process acting as a demand response must react quickly since the imbalances between supply and demand, which it is engaged to stabilize, are often short-lived and hard to predict.

- High availability: Availability relates to the up-time of the process. If a process is continuously running at full capacity, it will always be able to sell its electricity back to the grid.

- Low cost of reacting: A company will only reduce its electricity consumption if it’s financially beneficial for them to do so. In other words, the payments for reducing electricity consumption must be higher than their cost of reacting. Therefore, a high cost of reacting limits the possibilities for a process to reduce its electricity consumption on short notice. Most big electricity consumers are factories that have very high costs of reacting since they often can’t afford to stop production at irregular intervals.

- High consumption level granularity: A process where it’s possible to adjust the electricity consumption in a very granular way is preferable to a process where you only have two choices: consume at full capacity or shut the operation down entirely. The reason is that a process that can turn its electricity consumption up or down through many levels can sell many different amounts of electricity back to the market instead of just one amount.

- High geographic flexibility: Demand response is about providing flexibility to local electric power systems. If processes can locate themselves almost anywhere, they can be used for demand response in many different electric power systems. In addition, many of the regions where demand response is needed the most are located in high variable renewable energy clusters far away from population centres, like West Texas. Most industries are relatively inflexible when it comes to where to locate their processes. Examples of sources of such inflexibility can be access to workforce, raw materials and logistics networks for their finished products.

How suitable is bitcoin mining as demand response?

To get a grasp on if bitcoin mining is suitable as demand response, we can now evaluate the process based on the demand response flexibility factors:Energy intensity

CBECI (2021) estimates the bitcoin mining industry to have a power draw of 10GW and an annualized consumption of 99TWh. Based on these numbers and the world's total electricity consumption (IEA, 2020), bitcoin mining is responsible for around 0.4% of global electricity consumption. This undoubtedly makes bitcoin mining a highly energy-intensive industry. In addition, economies of scale are extremely important to draw down costs and be competitive, so most of the individual mining sites are huge electricity consumers. As explained earlier, processes that draw a minimum of 100 kilowatts can be candidates for demand response. One of the most popular machines for bitcoin mining (ASIC), Antminer S19, has a power consumption of 3.25 kilowatts. A bitcoin miner needs about 30 of these to be eligible to participate in demand response programs. Most bitcoin mining facilities have thousands of machines like these.Reaction time

ASICs are computers and can therefore quickly adjust their electricity consumption. The ASICs can be connected to a control panel that lets the administrator adjust their power draw at a moment's notice. This process can be automated based on factors such as electricity price or grid frequency. According to Lancium, their patented demand response software allows bitcoin miners' and other data centres to ramp up or down their electricity consumption in as little as five seconds. This reaction time is on par with the fastest reacting peaking plants and lets bitcoin miners in Texas participate in the demand response programs that require the quickest reaction times.Availability

Bitcoin miners are economically incentivized to constantly produce at full capacity since they have significant investments in machines that they are eager to earn back. Because of this, bitcoin miners are highly reliable and stable loads with excellent availability.Cost of reacting

Bitcoin mining is a straightforward operation: A bitcoin miner owns computing hardware, feeds it with electricity and receives bitcoin in return. It's a probabilistic game where, in the long-term, the amount of bitcoin a miner earns depends solely on their computing power, which again depends on their electricity consumption. A bitcoin miner transforms electricity into bitcoin. At what time of the day a bitcoin mining facility runs doesn't matter. Bitcoin mining's computations can be characterized as a non-time-sensitive computation (Maze-Rothstein, 2021) because there are no clients (except for the Bitcoin network) and no requirements for up-time.In addition, a bitcoin miner has no costs related to the actual down-ramping of the facility's power consumption. The only cost of reacting for a bitcoin miner is the alternative cost of not mining bitcoin when the machines are turned off. For all industrial processes utilized as demand response, the alternative cost of not producing will always be the minimum cost of reacting, making bitcoin mining's cost of reacting minimally.Consumption level granularity

Liegl (2020) explains that physical power plants can usually only increase or decrease output in significant increments of 1 megawatt or more, while Virtual Power Plants (VPPs) can increase or decrease production in hyper-granular increments on the kilowatt level. A VPP consists of several flexible consumers who aggregate their combined demand response capabilities. In this respect, a bitcoin miner can be compared to a VPP, but there is one big difference. A bitcoin miner already can granularly increase or decrease its electricity consumption while the VPP must integrate several flexible consumers to get these capabilities. There are several ways miners can granularly adjust their electricity consumption: Miners usually have several thousands of ASICs, so they can change the total number of ASICs running at any time, or they can adjust the effect of each ASIC. It's safe to say that there is no other electricity consuming processes with a higher consumption level granularity than bitcoin.Geographic flexibility

As explained, all processes have constraints limiting their geographic flexibility, although to different degrees. Examples of such constraints include: Access to labor; access to raw materials and other input factors; and access to distribution networks for their products and services.Bitcoin mining is not a labour intensive industry. When the data centre is up and running, the workforce mainly consists of technicians who control and configure the machines and other technical equipment. Workers fulfilling the requirements for such roles can be found in most locations.When it comes to access to raw materials and other input factors, bitcoin miners need ASICs, electricity and cooling systems. ASICs and cooling systems are capital expenditures and only need to be deployed once and can practically be shipped to any location with a road connection. As described by Bendiksen & Gibbons (2019), up until just a couple of years ago, it was more important for miners to have quick access to the newest and most powerful ASICs, while having access to the cheapest possible electricity came in second. Like most novel technologies, ASICs improved rapidly, so miners constantly had to upgrade them to stay competitive. Since the biggest ASIC manufacturers are located in China, it was natural for miners to locate themselves there too to get their hands on the newest machines before their western competitors. Therefore, in the first years of ASICs mining, miners were significantly less geographically flexible than they are now. This has changed, and most miners today prioritize having access to cheap electricity over having quick access to the newest ASICs. The reason is that the technological improvement rate of ASICs has drastically slowed down, leading to a longer lifetime of the machines and thus less importance of the newest gear.The most significant input factor for a bitcoin miner is electricity, and miners are dependent on having access to cheaper electricity than their competitors to stay profitable in the long term. This means that bitcoin miners are geographically tied to places where electricity is cheap. Nevertheless, the payments bitcoin miners in Texas have been able to receive by participating in demand response programs have up until now been high enough to reduce their electricity costs by well over 50%. These cost savings can open up many new locations for bitcoin miners where previously the electricity was too expensive, given that there are possibilities for doing demand response there. When it comes to access to distribution networks for their products, bitcoin miners distribute their product, processing power, over the internet. Their payments in bitcoin are also distributed to them through the internet.

Preview

In closing

Bitcoin mining is an energy-intensive and stable load that can be rapidly adjusted up or down with extreme precision at no extra costs. With an internet connection and access to electricity as the only geographic requirements, bitcoin miners are also extremely geographically flexible. They can easily locate themselves exactly where demand-side flexibility is needed. Judged by the demand response flexibility factors, bitcoin mining stands out as an excellent demand response. I can't think of other electricity consuming processes that scores as high as bitcoin mining on these factors.Bitcoin miners are often criticized for their considerable electricity consumption, but it's essential to consider how bitcoin miners consume electricity. Because of their high flexibility, bitcoin miners provide positive externalities to electricity systems worldwide that are more difficult to measure than their energy consumption in TWh. Before we discuss bitcoin miners' electricity consumption, it's important to be aware of the following points:- We desperately need to increase the demand side's flexibility since we lose a significant share of the supply-side's flexibility when replacing reliable fossil fuel power plants with variable wind and solar farms as part of the energy transition. Demand response is currently the cheapest and most widely available source of demand-side flexibility.

- Bitcoin mining has the most flexible demand profile of all industries and is exceptionally suitable for usage as a demand response.

Sources and interesting reading on the topic

- How bitcoin mining can support the energy transition - Maze-Rothstein (2021)

- Blockchain mining delivers flexibility to Sweden’s energy market - Jones (2021)

- North American Bitcoin Mining Index (NABMI) - Quigley (2021)

- Lancium

- ERCOT Demand Response

- Demand-side flexibility for power sector transformation - Fernández & Taibi (2019)

- Wind and solar now generate one-tenth of global electricity - Ember (2020)

- Energy Transition Outlook 2021 - DNV GL (2021)

- Get paid for your flexibility - EnelX (2021)

- Cambridge Bitcoin Electricity Consumption Index (CBECI)

- Electricity Information: Overview - IEA (2021)

- Demand Response - IEA (2020)

- The bitcoin mining network: Trends, average creation costs, electricity consumption and & sources - Bendiksen & Gibbons (2019)

- Twitter thread about virtual power plants - Liegl (2020)